|

Waters Blasts FDIC Chairman McWilliams’ Attempt to Block Bank Merger Protections for Working Families

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, released the following statement on the Federal Deposit Insurance Corporation (FDIC) Chairman’s efforts to block a majority of the FDIC Board from updating bank merger review processes that would protect working families across this country from being denied access to capital and banking services.

“As I wrote last week, and at a time when a wave of megamergers is making our banking markets less competitive, I welcome the long-overdue steps by banking regulators to finally update their bank merger review procedures. However, I am deeply concerned by recent actions taken by the FDIC Chairman to—in an unilateral, unprecedented, and potentially unlawful move—attempt to thwart the will of the majority of the FDIC to seek public input on this matter. I am calling on Chairman Jelena McWilliams to explain her legal authority for attempting to veto this action approved by a majority of the FDIC Board, including by apparently directing agency staff to issue a public statement disavowing the sensible request for information from the public, and subsequently rejecting a motion to include the notational vote authorizing the request in the minutes at this week’s board meeting…”

Read Chairwoman Waters’ full statement HERE.

See here for Chairwoman Waters’ letter to Fed Chair Jerome Powell; FDIC Chair Jelena McWilliams; and Michael Hsu, Acting Comptroller of the Office of the Comptroller of the Currency (OCC), affirming the importance of these reviews and urging their agencies to impose a moratorium on approving any large bank M&A over $100 billion while these reviews take place. Read the full letter HERE.

Full Committee Convenes for First-Ever Congressional Hearing with Cryptocurrency CEOs

The full Committee convened for a historic hearing entitled, “Digital Assets and the Future of Finance: Understanding the Challenges and Benefits of Financial Innovation in the United States.”

Per Chairwoman Waters’ opening statement, “The hearing was part of this Committee’s ongoing review of digital assets. Earlier this year, [Chairwoman Waters] created a Digital Assets Working Group of Democratic Members to meet with leading regulators, advocates, and other experts on how these novel products and services are reshaping our financial system. We have also held several subcommittee and task force hearings earlier this year to better understand the landscape of this industry. This hearing and subsequent hearings on this topic will help this Committee consider how to support responsible innovation that protects consumers and investors, safeguards our financial system from systemic risks, promotes inclusion, addresses environmental concerns, as well as to consider a potential Central Bank Digital Currency.”

At the hearing, Committee Members heard testimony from:

- Jeremy Allaire, Co-Founder, Chairman and CEO, Circle

- Samuel Bankman-Fried, CEO and Founder, FTX

- Brian P. Brooks, CEO, Bitfury Group

- Charles Cascarilla, CEO and co-Founder, Paxos Trust Company

- Denelle Dixon, CEO and Executive Director, Stellar Development Foundation

- Alesia Jeanne Haas, CEO, Coinbase Inc. and CFO, Coinbase Global Inc.

Read Chairwoman Waters’ full Opening Statement HERE.

Waters Applauds FSOC and OCC Actions to Address Climate-Related Financial Risk

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, released the following statement in response to the Office of the Comptroller of the Currency’s (OCC) releasing principles on climate-related financial risk, and the Financial Stability Oversight Council (FSOC) establishing a Climate-related Financial Risk Committee within FSOC:

“Last year, I called on President-Elect Biden to ensure that financial regulatory agencies prioritized climate change to help us address this existential threat. So, I am pleased that Acting Comptroller Michael Hsu and the OCC have started acting on this threat by initiating a process for climate risk supervision. If finalized, the guidance that these principles are aimed at producing would be historic, representing the first time that a federal banking regulator in the United States acted to require financial institutions to measure and manage climate risk. Importantly, the OCC’s principles expect bank management to prepare a scenario analysis, which can be a useful tool in understanding and mitigating climate risk. The OCC also expects bank management to understand a broad range of climate-related financial risks, including interest rate risk. This is especially critical in light of recent financial stability warnings about re-pricing of risky carbon intensive assets, including distressed oil and gas companies, in the event of a tighter monetary policy environment. Acting Comptroller Hsu’s actions follow commitments from President Biden, Treasury Secretary Yellen, and the FSOC that regulators will address climate change as a threat to the safety and stability of our financial system. The establishment of the Climate-related Financial Risk Committee within the FSOC, which I also recommended to President-elect Biden last year, is another welcome measure…”

Read Chairwoman Waters’ full statement HERE.

December Tweets December Tweets

|

|

|

Member Spotlight Member Spotlight

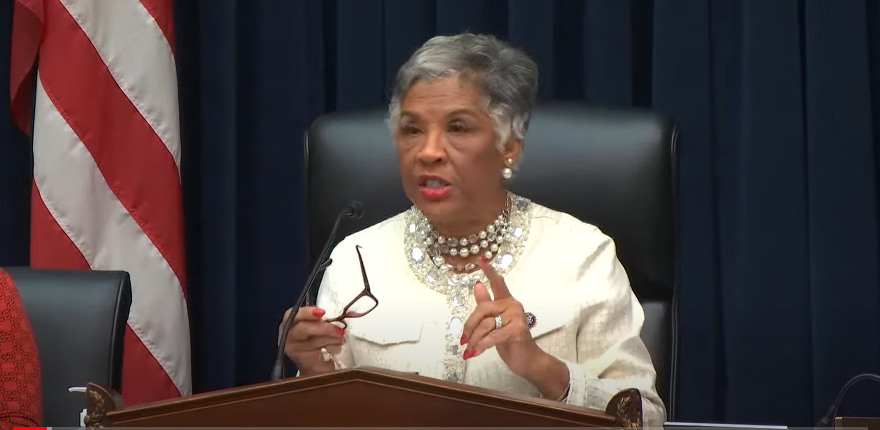

| Congresswoman Joyce Beatty (D-OH) |

Congresswoman Joyce Beatty (D-OH) is the Chair of the first-ever Subcommittee on Diversity and Inclusion. Rep. Beatty led an effort that culminated in a groundbreaking report that the Committee released paired with a Subcommittee on Diversity and Inclusion hearing on the diversity and inclusion performance at America’s largest investment banks, which she chaired.

Rep. Beatty also serves on the Subcommittee on Housing, Community Development and Insurance.

Chairwoman Waters and Subcommittee Chair Beatty Release New Report on Diversity and Inclusion Performance at Nation’s Largest Investment Banks

Chairwoman Waters and Diversity and Inclusion Subcommittee Chair Joyce Beatty released a Majority staff report on the performance of the nation’s largest investment banks on diversity and inclusion.

Immediately after George Floyd’s murder, large firms and financial institutions made public statements which included commitments to diversify their workforce and implement programs, practices, and policies that aim to increase both racial and gender equity. To promote transparency and accountability for diversity performance and encourage economic inclusion, the Committee requested data from investment firms with assets over $400 billion to report and comment on their diversity and inclusion data and practices.

The data requests were designed to inform Congress of the diversity levels, policies and practices of the country’s largest investment firms.

Find the full report HERE.

Waters Congratulates Alanna McCargo on Confirmation as President of Ginnie Mae

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Financial Services Committee, released a statement congratulating Alanna McCargo on her confirmation as President of the Government National Mortgage Association (Ginnie Mae) this week.

“I would like to congratulate Alanna McCargo and the Biden Administration on this week’s Senate confirmation of Ms. McCargo as President of the Government National Mortgage Association (Ginnie Mae). She brings with her decades of expertise and leadership experience in the housing finance industry, having worked in both the private and nonprofit sectors as well as federal government. This includes her time with the Department of the Treasury during the Obama Administration where she led recovery efforts during the post-2008 financial crisis, her role as Vice President of the Urban Institute’s Housing Finance Policy Center, and most recently as Senior Advisor for Housing Finance for Department of Housing and Urban Development (HUD) Secretary Marcia Fudge…”

Read Chairwoman Waters’ full statement HERE.

Waters Applauds Biden’s Nomination of Sandra L. Thompson as FHFA’s Permanent Director

Chairwoman Waters released a statement applauding President Biden’s announcement to nominate Acting Director Sandra L. Thompson to continue her leadership of the Federal Housing Finance Agency (FHFA). On September 16, 2021, Chairwoman Waters called on President Biden to nominate Ms. Sandra L. Thompson for Director of the FHFA.

Read Chairwoman Waters’ full statement HERE.

Holiday Reads Holiday Reads

Chairwoman’s Corner Chairwoman’s Corner

Chairwoman Waters’ Opening Statement on Diversity and Inclusion Performance at America’s Largest Investment Firms: “Transparency and Accountability Is the Path to Progress”

Thank you so very much, Chair Beatty. I am proud that your efforts have culminated in yet another groundbreaking report, this time on the diversity of our nation’s largest investment firms.

In March 2021, Chair Beatty and I sent letters to 31 firms that manage more than $400 billion in assets, and requested their diversity and inclusion data, practices, and policies.

The firms in this report oversee assets totaling more than twice the size of the United States GDP. They invest the retirement savings of millions of Americans and drive investment in companies and communities.

The Committee’s report makes clear that these firms have much work to do; and transparency and accountability is the path to progress.

So, I look forward to discussing the findings of this report. And again, I thank you so very much, Chair Beatty, for the progress that you are making in this whole area of diversity and inclusion.

###

|