|

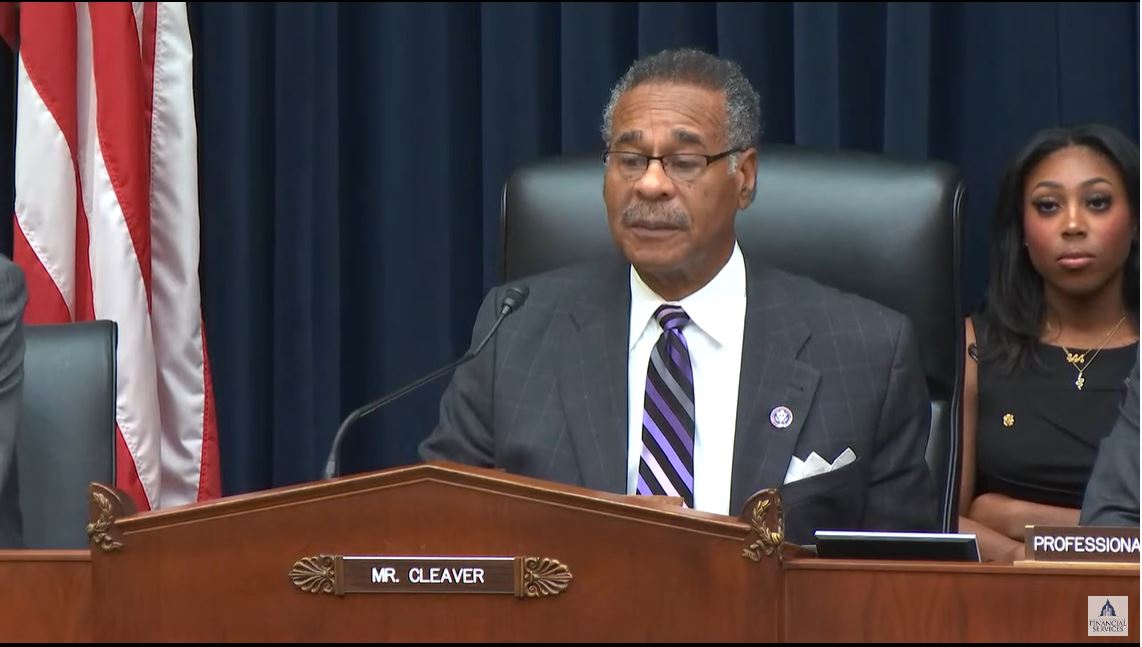

Waters Convenes Full Committee Hearing with the CEOs of America’s Largest Commercial Banks

On Wednesday, Chairwoman Waters convened a full committee hearing entitled, “Holding Megabanks Accountable: Oversight of America’s Largest Consumer Facing Banks.” With an ongoing pandemic, rising interest rates and Russia’s invasion of Ukraine, economic conditions for families are worsening. During today’s hearing, Committee Democrats, under the leadership of Chairwoman Waters explored a number of issues impacting consumers, including:

- Rise of bank mergers, which has closed branches across the country and expanded banking deserts for communities that rely on banking services.

- Efforts to close the nation’s widening racial-wealth gap and build on the commitments they made following the murder of George Floyd.

- Efforts to make consumers harmed by Equifax whole again.

- These institutions repeated violation of the law, earning them the title “repeat offenders.”

- Rise of emerging technologies, and how these banks are making whole consumers scammed through payments apps like Zelle.

- Efforts to protect employees following the Supreme Court’s shameful decision to abolish Roe v. Wade and their efforts to combat gun violence.

In case you missed it, read a recap of the full Committee hearing HERE.

Waters and Beatty Release Latest Committee Staff Report; Highlights Diversity Shortcomings at America’s Largest Insurance Companies

On Monday, Chairwoman Waters and Congresswoman Joyce Beatty (D-OH), Chair of the Subcommittee on Diversity and Inclusion, released a Majority staff report entitled, “Diversity and Inclusion: Holding America’s Largest Insurance Companies Accountable.” On Tuesday, the Subcommittee on Diversity and Inclusion held a hearing discussing the report’s findings and recommendations.

While the insurance industry is a unique sector of financial services that has much less federal oversight than the rest of the financial services industry, it plays an extensive role in the everyday lives of consumers, given that it is often a requirement to obtain certain types of insurance. This report, which highlights the lack of diversity in the nation’s largest Property & Casualty (P&C) and life insurance companies, is the third in a series conducted by the Financial Services Committee and led by the Subcommittee on Diversity and Inclusion to hold the financial services industry accountable on its diversity and inclusion efforts.

- Read the full report, including staff findings and recommendations, HERE.

- Read the press release HERE.

Chairs Waters and Velázquez Urge Biden Administration to Approve Additional Assistance to Help Puerto Ricans Recover Equitably form Hurricane Fiona

Following the devastating impact of Hurricane Fiona that has displaced millions of families across Puerto Rico, today, Chairwoman Waters and Congresswoman Nydia M. Velázquez (D-NY), Chairwoman of the House Committee on Small Business, sent a letter to President Biden calling on the administration to remain steadfast in its commitment to equitable disaster recovery by moving quickly to approve every municipality in Puerto Rico for Individual Assistance (IA) through FEMA, which allows impacted families to apply for financial and direct assistance to cover housing and other necessary expenses.

- Read the press release HERE.

- Read the full letter HERE.

Waters Joins Vice President Harris, Treasury Secretary Yellen, and Senator Warren to Announce Over $8 Billion in Investments in CDFIs and MDIs

On Wednesday, Chairwoman Waters joined Vice President Kamala D. Harris, Treasury Secretary Janet L. Yellen, and Senator Mark Warner (D-VA) to announce that the Biden-Harris Administration has made over $8.28 billion of investments through the Emergency Capital Investment Program (ECIP) to benefit 162 community financial institutions, including minority depository institutions (MDIs) and community development financial institutions (CDFIs).

Read Chairwoman Waters’ remarks HERE.

|

|

Member Spotlight

| Congressman Gregory Meeks (D-NY) |

Congressman Gregory Meeks (D-NY) serves as on the Subcommittee on Consumer Protection and Financial Institutions and on the Subcommittee on Investor Protection, Entrepreneurship, and Capital Markets. At this week’s full Committee hearing, Rep. Meeks pressed the CEOs of America’s largest commercial banks on questions concerning diversity and inclusion in their workforces and their lending practices in communities of color.

The Committee also convened a subcommittee hearing to discuss diversity and inclusion shortcomings and efforts at America’s largest insurance companies. Rep. Meeks’ bill, the “Improving Corporate Governance Through Diversity Act,” would require public companies, including insurance companies, to annually disclose the voluntarily, self-identified gender, race, ethnicity and veteran status of their board directors, nominees, and senior executive officers to improve diversity and inclusion policies and practices.

Weekend Reads

###

Committee Hearings

Holding Megabanks Accountable: Oversight of America’s Largest Consumer Facing Banks

The full Committee held a hearing with the CEOs of the seven largest commercial banks. During the hearing, the CEOs were asked about the efforts they’ve made to update their banking services to better serve communities, their response to Russia’s invasion of Ukraine, their diversity and inclusion efforts, and consumer protection issues, among many other lines of questioning from Members of the Committee.

- Read Chairwoman Waters’ opening statement HERE.

- Watch the full Committee hearing HERE.

Under the Radar: Alternative Payment Systems and the National Security Impacts of Their Growth

The Subcommittee on National Security, International Development, and Monetary Policy held a hearing to explore the emergence of alternative payment systems. During the hearing, both Members of the Committee and witnesses discussed how alternative payment systems can be used by U.S. adversaries to hurt the strength of the U.S. dollar, make U.S. sanctions ineffective, and impact our ability to identify financial crime.

- Read Chairwoman Waters’ opening statement HERE.

- Watch the subcommittee hearing HERE.

A Review of Diversity and Inclusion at America’s Largest Insurance Companies

The Subcommittee on Diversity and Inclusion held a hearing following the release of a groundbreaking report on the lack of diversity at the largest Property & Casualty insurance and life insurance firms. During the hearing, Members of the Committee sounded the alarm on the report’s finding that the nearly 90% of CEOs at insurance companies are White men.

- Read Chairwoman Waters’ opening statement HERE.

- Watch the subcommittee hearing HERE.

State of Emergency: Examining the Impact of Growing Wildfire Risk on the Insurance Market

The Subcommittee on Housing, Community Development and Insurance held a hearing to examine the growing wildfire risk on the insurance market. During the hearing, Members discussed the risk that communities across the country, but particularly in rural areas, face because of increasingly destructive wildfires that push insurance companies to stop offering coverage to homeowners or significantly raise insurance rates.

- Watch the full Committee hearing HERE.

Chairwoman’s Corner

Waters Releases Statement on World Bank President’s Comments on Climate Change

Congresswoman Maxine Waters (D-CA), Chairwoman of the Committee on Financial Services, released the following statement in response to World Bank President David Malpass’s refusal to accept the scientific consensus that the burning of fossil fuels is dangerously warming the planet:

“President Malpass’s refusal to accept the overwhelming scientific consensus that human activity, specifically, the burning of fossil fuels, is the main driver of climate change is appalling.

“It’s extremely concerning that the leader of the world’s premier development institution and largest source of climate finance would call into question the vast scientific evidence upon which the Bank’s climate work is presumably based or should be.

“President Malpass’s unwillingness to acknowledge the central role that fossil fuel emissions play in climate change calls into question the Bank’s commitment to meeting the climate challenge, including efforts to help ensure a just transition away from fossil fuels in developing countries.

“In rejecting the widely accepted current state of knowledge about climate change, Malpass is undermining the World Bank’s leadership in the global response to the threat of climate change, which, in turn, threatens the Bank’s relevance in every other area, including its mission to alleviate poverty and promote sustainable growth.”

Read the full press release HERE.

|