Committee Anti-Crypto Corruption Week Releases

Day 1

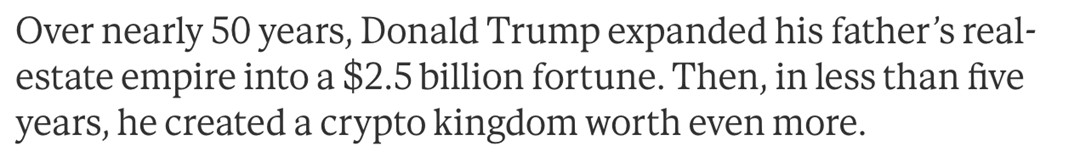

On Day 1 of Anti-Crypto Corruption Week, Ranking Member Maxine Waters and Committee Democrats are shining a light on just how shady President Donald Trump’s memecoin scam really is. In case you forgot, Trump once railed against crypto on Fox Business in 2021 and declared that he wanted the U.S. dollar to remain the “currency of the world.”

What changed? He realized just how much money he could make from it.

On January 17, just three days before Trump was inaugurated as President, he launched his $TRUMP memecoin, which, in just a few weeks, helped significantly inflate his net worth by at least $350 million while defrauding investors of over $2 billion. This is a textbook example of a pump and dump scheme, allowing his insiders the ability to buy in early and cash out at the expense of regular investors.

That’s not all.

The $TRUMP memecoin:

- Serves NO purpose. It only has value because of Trump’s name and public profile. It exists only to extract money from investors and sell access to the White House.

- Is a clear violation of securities laws. Trump continues to profit off the memecoin without proper guardrails. Under Trump’s SEC, memecoins are conveniently not considered a security – so nothing will be done.

- Creates a gateway for foreign money and influence into the White House and our political system through unregulated, potentially anonymous cryptocurrency transactions.

The New Republic sums up $TRUMP as a “vessel for corruption”:

After launching the memecoin, Trump hosted the top holders of his memecoin to dine at his private golf club in Virginia (which was a massive scam, btw. Here’s what some of the attendees had to say). People spent an estimated $148 million to attend these events. Of the top 25 $TRUMP holders vying for this VIP dinner, 19 used foreign exchanges, meaning they appeared to be foreign nationals. More than half of the top 220 wallets were linked to similar offshore platforms. The idea that foreign individuals can buy their way into Trump’s inner circle through a crypto scheme is blatant corruption and a massive national security risk. Clear as day.

To stop this blatant memecoin scam, Members of Congress must vote “NO” on the so-called “CLARITY” and “GENIUS” Acts which give Trump a greenlight to continue this memecoin scam. Congress should also pass Ranking Member Waters’ “Stop TRUMP in Crypto Act of 2025.”

###

Day 2

On Day 2 of Anti-Crypto Corruption Week, Ranking Member Maxine Waters and Committee Democrats are shining a light on Trump’s shady crypto venture, World Liberty Financial. Drawing from the New York Times’ exposé : Secret Deals, Foreign Investments, Presidential Policy Changes: The Rise of Trump’s Crypto Firm.

World Liberty Financial (WLF), a self-described Decentralized Finance cryptocurrency firm, largely owned by Donald Trump and his family, has blurred the line between presidential power and private profit. Since Trump’s return to the White House, the company has profited from favorable policy changes and aggressive international fundraising, raising over $550 million – with 75% of coin sales revenue flowing to the Trump family.

Who’s Involved?

Founded by Trump’s sons with business partners Zachary Folkman, Chase Herro, and Zach Witkoff, World Liberty pitched secretive “mutual investment” deals requiring large payments for Trump brand association. Some firms declined, calling it unethical.

Fraudulent Stablecoin Launch:

World Liberty Financial announced its stablecoin, USD1, right after Trump endorsed the GENIUS Act, stablecoin legislation the House is rushing through Congress now. Partners include Binance, whose founder is seeking a Trump pardon.

A Vessel for Political and Regulatory Influence:

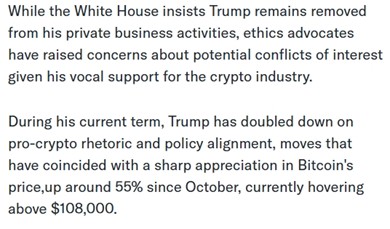

As discussed on day 1, Trump reversed his anti-crypto stance. He then moved immediately to stacking his Administration with crypto-friendly appointees and dissolving Biden-era enforcement task forces (*More on this on Day 4. *). He declared crypto “the future” and launched a U.S. “crypto reserve,” causing price surges in coins held by World Liberty and other Trump Administration insiders.

That’s not all. In late 2024, crypto billionaire and businessman, Justin Sun invested $30 million in WLF, eventually increasing his stake to $75 million, making him the largest investor in the token. Following this investment, WLF announced it would use Sun’s technology to power its stablecoin. Soon after, the SEC paused its fraud investigation into Sun and his companies, which had been ongoing since 2023. This is the textbook definition of quid pro quo.

For more on Justin Sun, check out this story from the Guardian and Mother Jones.

WLF is another vehicle for Trump to profit and he’s not even trying to hide it.

To stop Trump’s WLF scheme, Members of Congress must vote “NO” on the so-called “CLARITY” and “GENIUS” Acts which give Trump a greenlight to continue this scam. Congress should also pass Ranking Member Waters’ “Stop TRUMP in Crypto Act of 2025.”

###

On Day 3, Ranking Member Waters and Committee Democrats are outlining how Trump’s World Liberty Financial Grift is a dangerous backdoor for selling influence over American policies to the highest foreign bidder. If you thought the private jet Trump accepted from the UAE was egregious and beyond the pale, keep reading. It gets even worse.

World Liberty Financial has received a significant portion of its funding from overseas, which has brought about serious ethical and national security concerns.

- Abu Dhabi used WLF’s stablecoin, USD1, to buy $2 billion worth of Binance shares: This was one of the biggest deals using USD1, and shows how foreign players are using Trump’s crypto likely to curry favor from the White House.

- Prominent investors from Hong Kong, UAE, and Israel: These countries accounted for a large share of the over $550 million raised by World Liberty. Investors include individuals and firms with substantial political and economic influence in their home countries, some of whom are under active investigation by U.S. agencies.

- Israeli Crypto Firm: The Israeli firm, under previous scrutiny for money laundering and unlicensed securities activity, now benefits from a host of deregulatory actions Trump has taken.

- Dubai-Based Group: A key investor from the UAE is currently under investigation by federal prosecutors for allegedly helping sanctioned oligarchs move funds. Despite this, the group secured a private investment in World Liberty Financial in early 2025, indicating a clear avenue for influence of goodwill building with the Trump Administration.

What’s clear is that foreign investment is not just a business deal, it’s a direct payment to the sitting U.S. president with the goal of currying favor and influence within the White House.

For more, read the full NYT story HERE.

To stop Trump from selling influence to foreign countries, Members of Congress must vote “NO” on the so-called “CLARITY” and “GENIUS” Acts which give Trump a greenlight to continue this scam. Congress should also pass Ranking Member Waters’ “Stop TRUMP in Crypto Act of 2025.”

###

Day 4

On Day 4 of Anti-Crypto Corruption Week, Ranking Member Maxine Waters and Committee Democrats are exposing how Donald Trump has sidelined crypto criminal watchdogs—so no one would be watching him. He stripped away the oversight mechanisms meant to keep crypto corruption in check, clearing the way for him and his allies to profit off their crypto cons in the shadows, unchecked.

One of Trump’s first moves in office: disbanding the Justice Department’s National Cryptocurrency Enforcement Team, the unit tasked with prosecuting crypto crime.

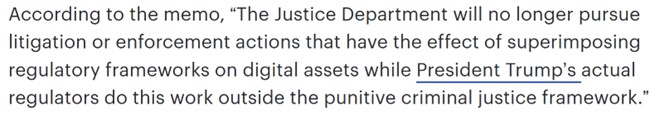

According to internal memos obtained by The Hill, Trump’s DOJ ordered prosecutors to shift attention away from crypto and toward politically convenient targets like immigration and procurement fraud.

The directive was part of an executive order to dismantle digital finance enforcement structures across the federal government, replacing meaningful oversight with vague “jurisdictional boundaries.”

Trump’s SEC also swept crypto fraud under the rug. Trump’s allies at the Securities and Exchange Commission followed suit: they dropped dozens of major enforcement actions launched during the Biden Administration. In the first month alone, the Trump Administration dropped cases or investigations against at least 89 companies.

According to Decrypt, this includes actions investigating some of the crypto industry’s biggest names:

- Binance: lawsuit alleging unregistered securities offerings

- Coinbase: investigation into crypto token listings and staking services

- Kraken: lawsuit related to staking-as-a-service products

- Ripple: long-running lawsuit over XRP’s regulatory status

- Robinhood: investigation into its crypto trading business

All were dismissed. These were not minor cases; they involved billions in alleged fraud and violations.

These dramatic reversals signal a new era: under Trump, the SEC will no longer pursue aggressive enforcement, even for serious violations like unregistered securities sales and fraudulent offerings.

Find Decrypt’s full list of cases dropped HERE.

The result of dismantling crypto oversight and ignoring fraud: a playground for scams. With both the DOJ and SEC out of the way, Trump’s message is clear: as long as you're part of his inner crime circle, you won’t face consequences. This regulatory void is no accident. It’s a deliberate invitation for corruption. And Trump has wasted no time taking full advantage.

To stop Trump from covering up his crypto crimes, Members of Congress must vote “NO” on the so-called “CLARITY” and “GENIUS” Acts which give Trump a greenlight to continue this scam. Congress should also pass Ranking Member Waters’ “Stop TRUMP in Crypto Act of 2025.”

###

Day 5

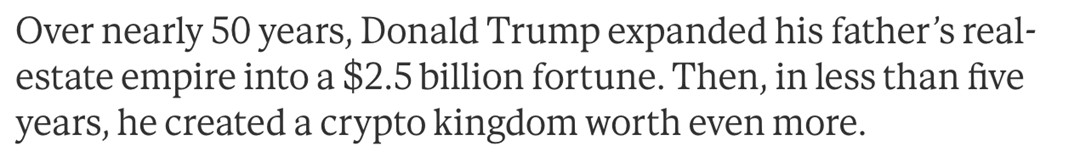

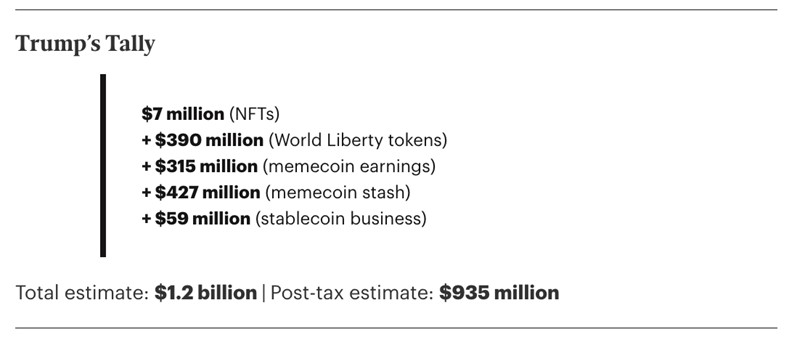

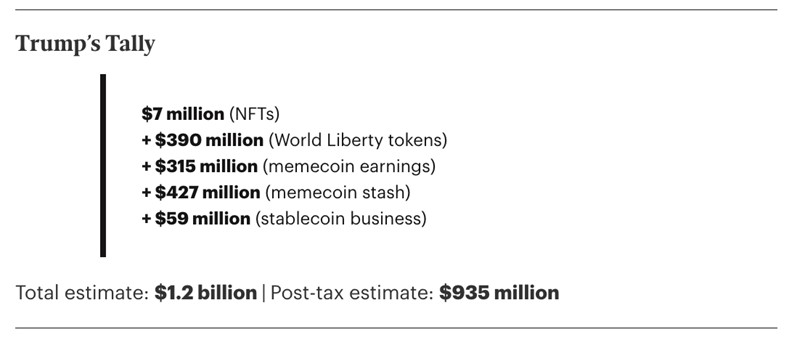

On the fifth and final day of Anti-Crypto Corruption Week, Ranking Member Maxine Waters and Committee Democrats are doing a deep dive into Trump’s staggering personal fortune made solely from his crypto schemes—$1.2 billion and counting, according to a Forbes investigation.

Source: Forbes

From day 1 in office, Trump has been doing everything in his power to ensure crypto watchdogs were put down and lawsuits were dropped. Meanwhile, he amassed a crypto fortune that now exceeds every property in his real estate portfolio. See how he got there:

Source: Forbes

Trump’s Crypto-Corruption Tally: Line by Line

$315 million – MAGA Memecoin: Trump licensed his name to a meme token and received a cut of the supply. As prices soared, his stake exploded in value.

$390 million – World Liberty Financial: A Trump-linked crypto firm. Trump and family reportedly got early equity and token allocations before launch.

$60 million – USD1 Stablecoin: Trump received early distributions from a “stable” coin pushed by his allies, raising major questions about motive and utility.

$6.6 million – Trump NFTs (Trump Cards): Digital trading cards of Trump in costumes minted on Ethereum and sold to fans.

$430 million – Misc. Tokens & Hidden Wallets: Additional holdings tied to private wallets, shell entities, and coins where Trump’s involvement was obscured.

$1.2 billion is only the beginning: Trump’s crypto fortune is growing exponentially every day. Just last week, Trump Media & Technology Group filed a third ETF proposal, with a majority of the fund allocated to bitcoin. It’s no coincidence that this is conveniently happening as bitcoin reaches record breaking highs—due to the corrupt crypto bills House Republicans are pushing this week on behalf of Trump.

The Blueprint for Crypto Corruption: Insider Access + No Oversight = $1.2 billion, seemingly overnight

- Private Dinners: Trump hosted secretive investor events, where high-dollar guests got early access to Trump-backed coins, before public markets even knew they existed.

- Minimal Transparency: Investors were kept in the dark and federal enforcement was slashed, so Trump could cash in behind the scenes.

- Rapid Token Launches: With enforcement gone, new Trump-backed coins and projects were launched with little vetting or disclosure.

Source: Forbes

Trump didn’t just get lucky in crypto; he rewrote the rules, then cashed in on the chaos he helped create. He gutted oversight, hyped risky tokens, and added to his billions off projects that left everyday investors in the dark. This isn’t innovation. It’s not decentralization. It’s corruption—rebranded as crypto.

And Trump’s $1.2 billion windfall is just the beginning of what happens when power, profit, and zero accountability collide.

To prevent Trump from profiting off the Presidency, Members of Congress must vote “NO” on the so-called “CLARITY” and “GENIUS” Acts which gives Trump a greenlight to continue this scam. Congress should also pass Ranking Member Waters’ “Stop TRUMP in Crypto Act of 2025.”

###