|

Waters and Beatty Request Diversity Data From the Nation’s Largest Investment Firms

On March 18, Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, and Congresswoman Joyce Beatty (D-OH), Chair of the Subcommittee on Diversity and Inclusion, sent requests to the nation’s 31 largest investment firms—those with $400 billion or more of assets under management—for data on their diversity and inclusion.

“We are making progress to ensure a comprehensive understanding of diversity and inclusion performance in the financial services industry,” the lawmakers wrote in the letter. “However, this cannot be achieved until organizations, especially the largest investment managers, disclose their diversity data and policies with the Offices of Minority and Women Inclusion, Congress, and the public.”

The requests are part of a longstanding effort to hold the financial services sector accountable and provide the American public with a complete picture of how financial firms are meeting their commitments to diversity and inclusion.

“With these data requests to America’s largest investment firms, we are continuing to hold the financial services industry accountable for diversity and inclusion,” said Chairwoman Waters. “Generally, investment firms have failed to prioritize diversity and inclusion on their staffs and boards, and have also failed to prioritize doing business with diverse-owned asset managers. Chair Beatty and I are requesting this information both to gain specific data about the diversity and inclusion policies, practices and outcomes from this sector, and to make clear that these firms will be held publicly accountable.”

“Investment managers play a critical role in our economy and have an enormous impact on countless families’ lives,” said Chair Beatty. “It’s imperative stakeholders be given access to related diversity data to ensure accountability, transparency, and greater confidence in the very people Americans entrust with their livelihood and financial future.”

The lawmakers requested information about each institution’s diversity and inclusion data and policies from 2016 through the present, including:

- workforce and board diversity;

- spending with diverse suppliers, including the use of diverse asset management firms; and

- challenges implementing diversity and inclusion policies and practices.

Click here for the full list of firms that received requests.

Tweets of the Week

|

|

Member Spotlight

Congresswoman Joyce Beatty (D-OH) |

This week, Congresswoman Joyce Beatty (D-OH), Chair of the Subcommittee on Diversity and Inclusion, chaired her first hearing of the Subcommittee for the 117th Congress.

Watch the virtual hearing, entitled “By the Numbers: How Diversity Data Can Measure Commitment to Diversity, Equity and Inclusion,” here.

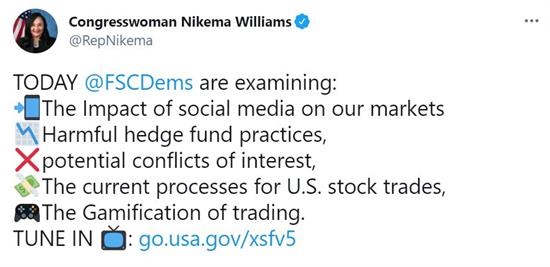

Waters at Second Hearing on Ongoing Market Volatility: The Committee Must Assess Legislative Next Steps

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, gave the following opening statement at a full Committee virtual hearing entitled, “Game Stopped? Who Wins and Loses When Short Sellers, Social Media, and Retail Investors Collide, Part II.”

Good morning every one. Today this Committee convenes for our second hearing on the ongoing volatility involving GameStop and other stocks.

In our first hearing on this matter, I called a number of those involved in those events to testify before the Committee. The goal was to get the facts. And so, we heard directly from the CEOs of trading app Robinhood, Wall Street firms Citadel and Melvin Capital, and social media company Reddit, as well as Keith Gill, one of the retail investors involved in WallStreetBets.

The Committee asked those witnesses questions on a broad range of issues, touching upon topics including conflicts of interest and payment for order flow, gamification of trading and harm to retail investors, the process for clearing and settling stock trades in the United States, and the ways that social media and technology are changing the way our markets function, as well as other related issues…

See here for the full text of her opening remarks.

Weekend Reads

Chairwoman’s Corner

Waters at Subcommittee Hearing on Diversity Data: We Are Continuing to Hold the Financial Services Industry Accountable

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, gave the following opening statement at a Subcommittee on Diversity and Inclusion virtual hearing entitled, “By the Numbers: How Diversity Data Can Measure Commitment to Diversity, Equity and Inclusion.”

Today, we are continuing to hold the financial services industry accountable for diversity and inclusion. I am pleased to partner with you, Ms. Beatty in requesting diversity data and policies from America’s largest investment firms. In addition to having an abysmal record of diversity within their investment firms, they have also not made it a priority to do business with diverse-owned asset managers and other businesses. Their excuses are not new and are ladened with long-standing, unfounded biases against diverse-owned asset managers, who perform as well as or better than their White-owned counterparts. And so, investment firms and others in the industry have also been reticent to share this data. But the data are needed to not only show the failing record, but to document their improvement. So, I look forward to discussing solutions to increase disclosure of diversity data which is indeed material to investors, and information that Congress and the public should have access to.

|