|

Waters Announces Introduction of Groundbreaking Legislative Housing Package

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, released the following statement on her legislative housing package.

“Our nation is in the midst of a housing crisis, which has been decades in the making. Due to a consistent lack of investment in affordable housing under Democratic and Republican administrations, we now find ourselves at a crossroads. To this day, more than 580,000 people are experiencing homelessness, 10.5 million households are paying more than 50 percent of their income on rent, and more than 20 million mortgage-ready individuals are unable to realize their dream of homeownership. Without a stable home, children cannot thrive; without a stable home, families are forced to choose between a roof over their head and a meal; and without a stable home, many people lack the foundation necessary to plan for the future.

“Now, for the first time in a generation, we have a real opportunity to fix these deep-rooted issues in our housing system. We can end homelessness. We can make rental housing affordable. We can provide the American dream of homeownership. We can do all of this by finally making the investments that we have postponed, diminished, or denied for years. The reconciliation bill provides us with a once-in-a-generation opportunity to provide the housing resources that our country so desperately needs.

“For these reasons, I am introducing legislation that ends homelessness, supports first-generation homebuyers in purchasing their first home, and ensures that housing is infrastructure. Now is the time to finally make housing a top priority and these bills do just that. This historic investment should be included in budget reconciliation as it will change housing as we know it for the better. We’ve waited long enough for housing to be a priority. The time to act is now.”

Click here to read her press release.

###

HOUSING IS INFRASTRUCTURE

The legislative housing package led by Congresswoman Maxine Waters includes:

- The Housing is Infrastructure Act of 2021 would provide a historic investment of over $600 billion in equitable, affordable, and accessible housing infrastructure. This generational investment would address our national eviction and homelessness crises, increase access to homeownership, and support a robust recovery from the pandemic by creating jobs, addressing climate change, and improving housing stability for struggling households. Click here for bill text.

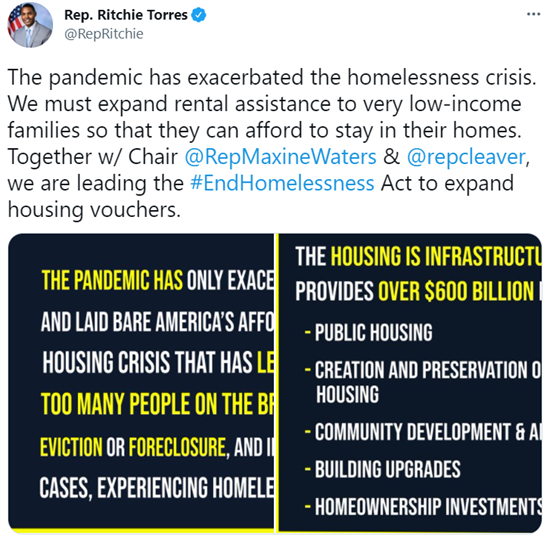

- The Ending Homelessness Act of 2021 would end homelessness and significantly reduce poverty in America by transforming the Housing Choice Voucher program into a federal entitlement, so that every household who qualifies for assistance would receive it. The lead cosponsors of this bill are Representative Emanuel Cleaver (D-MO) and Representative Ritchie Torres (D-NY). Click here for bill text.

- The Downpayment Toward Equity Act of 2021 would help address the U.S. racial wealth and homeownership gaps by providing $100 billion toward downpayment and other financial assistance for first-generation homebuyers to purchase their first home. The lead cosponsors of this bill are Representative Al Green (D-TX), Representative Ayanna Pressley (D-MA), Representative Jesús “Chuy” García (D-IL), Representative Cindy Axne (D-IA), and Representative Sylvia Garcia (D-TX). Click here for bill text.

See below for legislative fact sheets.

Housing is Infrastructure Act of 2021

The Ending Homelessness Act of 2021

The Downpayment Toward Equity Act of 2021

###

Subcommittee/Task Force Hearings

Subcommittee on Oversight and Investigations - CDBG Disaster Recovery: States, Cities, and Denials of Funding

Task Force on Artificial Intelligence - I Am Who I Say I Am: Verifying Identity while Preserving Privacy in the Digital Age

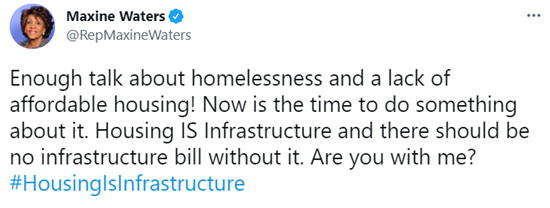

Tweets of the Week

###

|

|

Member Spotlight

| Congresswoman Madeleine Dean (D-PA) |

Congresswoman Madeleine Dean (D-PA), serves as on the Subcommittee on National Security, International Development and Monetary Policy and the Subcommittee on Diversity and Inclusion.

Weekend Reads

July Committee Calendar Updates

- July 20 at 10:00 AM ET: The full Committee will convene for an in-person hearing entitled, “Building Back A Better, More Equitable Housing Infrastructure for America: Oversight of the Department of Housing and Urban Development.”

- July 21 at 10:00 AM ET: The Subcommittee on Consumer Protection and Financial Institutions will convene for an in-person hearing entitled, “Banking the Unbanked: Exploring Private and Public Efforts to Expand Access to the Financial System.”

- July 21 at 2:00 PM ET: The Subcommittee on Investor Protection, Entrepreneurship and Capital Markets will convene for an in-person hearing entitled, “Bond Rating Agencies: Examining the “Nationally Recognized” Statistical Rating Organizations.”

- July 27 at 10:00 AM ET: The Subcommittee on National Security, International Development and Monetary Policy will convene for an in-person hearing entitled, “The Promises and Perils of Central Bank Digital Currencies.”

- July 27 at 2:00 PM ET: The Subcommittee on Housing, Community Development and Insurance will convene for an in-person hearing entitled, “NAHASDA Reauthorization: Addressing Historic Disinvestment and the Ongoing Plight of the Freedmen in Native American Communities.”

- July 28 at 10:00 AM ET: The full Committee will convene for an in-person markup.

All hearings are livestreamed on https://democrats-financialservices.house.gov/live/.

For virtual hearings, all Members and witnesses participate remotely with no in-person hearings participation in the hearing room. In-person will take place in 2128 Rayburn House Office Building.

Committee activities are finalized once an official notice is issued by the House Financial Services Committee. Visit https://democrats-financialservices.house.gov/calendar/ for the most up-to-date Committee schedule.

###

Waters at Hearing on the State of the Economy: The Fed Must Play a Central Role in This Economic Transformation

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, gave the following statement at a full Committee virtual hearing entitled, “Monetary Policy and the State of the Economy.”

“First, I would like to welcome back, Chair Powell. We’re delighted to have you with us here today.

“Much has happened since the last time you testified on the Fed’s Monetary Policy Report in February. Since then, Democrats passed, and President Biden signed into law, the American Rescue Plan. Because of the American Rescue Plan, more than 58 percent of adults in the United States have been fully vaccinated, and businesses are reopening. More than three million jobs were added to our economy in the Biden Administration’s first five months – the most in any President’s first five months – compared to just over two million jobs created during the first 12 months of Trump’s reckless tenure. And the latest jobs report shows that 850,000 jobs were added to the economy in June alone, a tremendous increase that beat market expectations.

“Simply put, without the American Rescue Plan and the extraordinary leadership from the Biden Administration and Democrats in Congress, our economy would not be on the track to recover.

“But, we still have more work to do to put this crisis firmly behind us and build a more resilient economy for the future. For example, while the unemployment rate continues to fall, joblessness remains higher for Black and Latinx workers than it does for white workers. To be clear, we will not have a full recovery without closing this gap.

“While inflation has risen in recent months, Chair Powell, you and other experts have attributed this to short-term factors. Consumer demand is way up, with people once again dining out, buying cars, and purchasing homes. But supply chains haven’t yet kept up with this pace, which, as a result, has led to higher prices. I think the Fed is right when they say that this dynamic will subside, but I expect the Fed to continue to monitor high prices as it fulfills its dual mandate to promote price stability and full employment. At the same time, Congress should be considering whether it’s better to address semiconductor shortages and soaring home prices through smart investments, or face higher interest rates from the Fed...”

Click here to read her opening statement.

###

Waters Applauds President Biden’s Executive Order to Examine Bank Merger Practices, Urges Federal Reserve to Strengthen Merger Reviews

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, released the following statement on President Biden’s recent executive order encouraging the Department of Justice and prudential regulators to examine bank merger practices.

“I am very pleased that President Biden took the important step of encouraging the Department of Justice and relevant regulators to robustly scrutinize bank mergers — something I urged the President to do shortly after the election.

“The Federal Reserve's bank merger review guidelines have not been updated since 1995. Yet as the President's executive order makes clear, banking industry consolidation has increased considerably since then, with thousands of branch closures, and harmful repercussions for consumers, small businesses, and communities of color. President Biden’s executive order alludes to the fact that banking agencies have not blocked a bank merger in 15 years, suggesting the process has become a rubber stamp. Further underscoring this point, one of the specific mergers that I mentioned in my December letter to President Biden – PNC's acquisition of BBVA’s U.S. assets – was recently approved by the Fed without holding a public hearing on the application, creating the fifth largest commercial bank in the U.S. It is concerning that mergers and acquisitions of this size have been quickly waved through in recent years with limited opportunities for the public, including affected workers, consumers, and small businesses, to speak directly to Fed officials through hearings convened by the Fed.

“The Fed should review its outdated bank merger guidelines and carefully scrutinize concentration among large regional banks, especially in light of recent deregulation among that same group of banks, and the significant threats that concentration poses to our economy coming out of the pandemic. In recent years, we have seen major consolidation among large banks make markets less competitive, from Atlanta, Georgia to Traverse City, Michigan, as well as acquisitions by global systemically important banks that undermine financial stability. Unless the Fed updates the factors it takes into account when evaluating mergers to reflect the transformation in the financial sector that has occurred since 1995, it will not be able to properly assess which mergers serve the public interest and which do not.

“At a hearing with the prudential regulators in May, and in a letter today, I expressed my alarm at a recent report that indicated that the Federal Reserve is considering further weakening its standards for scrutinizing bank mergers. I urge Chair Powell and the leaders of the other banking agencies mentioned in President Biden’s executive order to heed the President’s encouragement and move swiftly in the opposite direction.”

Click here to read the press release and letter to Fed Chair Powell.

###

Chairwoman’s Corner

Waters Opening Statement at Hearing on Community Development Funding and Disaster Recovery

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, gave the following statement at a Subcommittee on Oversight and Investigations virtual hearing entitled, “CDBG Disaster Recovery: States, Cities, and Denials of Funding.”

“Thank you so very much, Chair Green. The disaster mitigation funding Congress has appropriated to Texas since 2018 was meant to finance infrastructure projects that would protect the most vulnerable communities from future disasters. Yet Texas awarded none of this money to Houston, which suffered the lion’s share of the damage from Hurricane Harvey.

“We know that hurricanes, wildfires, and other disasters are getting worse, endangering millions of Americans, their homes, and their businesses. To better prepare for future disasters, we must target mitigation funding directly to those who need it to protect those communities that are at highest risk. Today, I look forward to hearing from our witnesses about what went wrong in Texas and how to better prevent misallocation of disaster relief in the future.

“Thank you so very much for paying attention to this very important issue Congressman Green.”

###

|