|

Waters Applauds OCC, FDIC, and Federal Reserve Efforts to Undo Damage from Trump-Era Community Reinvestment Act Rule

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, released the following statement on the Office of the Comptroller of the Currency’s decision to rescind the 2020 Community Reinvestment Act rule and work with the Federal Deposit Insurance Corporation and the Federal Reserve to draft a new rule.

“Civil rights laws like the Community Reinvestment Act (CRA) are supposed to ensure that communities that have long been ignored get the investment they need, families can access homeownership, and consumers and small businesses get credit on fair, equal terms.

“It is a shame that the Trump Administration, under former Comptroller Joseph Otting’s direction, attempted to gut the CRA, which would have prevented low- and moderate-income communities from getting access to credit and investment for generations to come. Moreover, Otting took a “go it alone” approach to this rewrite: refusing to work collaboratively with his fellow regulators, ignoring feedback from community groups, and dismissing the concerns of Congress. This is why I pulled out all the stops to kill Otting’s proposal. The Committee held extensive hearings on Otting’s proposal; Committee Democrats crashed a meeting of regulators on the proposal; and the House ultimately passed a resolution of disapproval of Otting’s misguided rule…”

Click here to read her press release.

###

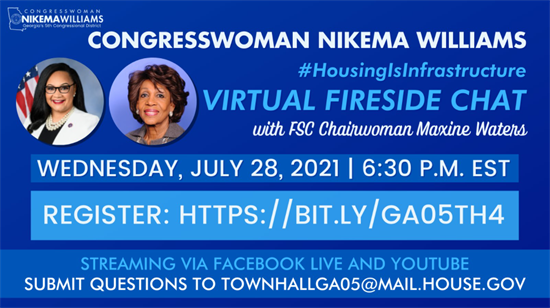

Housing Is Infrastructure

Rep. Nikema Williams hosts #HousingIsInfrastructure Fireside Chat Featuring FSC Chairwoman Maxine Waters

About the event: Congresswoman Nikema Williams welcomes you to join her exclusive Fireside Chat with House Financial Services Committee Chairwoman, Rep. Maxine Waters. You can submit your questions in advance to TownHallGA05@mail.house.gov as well as participate in the live Q&A on the Facebook and YouTube livestream the day of.

REGISTER at https://bit.ly/GA05TH4.

###

Housing is Infrastructure Legislative Package

The legislative housing package led by Congresswoman Maxine Waters includes:

- The Housing is Infrastructure Act of 2021 would provide a historic investment of over $600 billion in equitable, affordable, and accessible housing infrastructure. This generational investment would address our national eviction and homelessness crises, increase access to homeownership, and support a robust recovery from the pandemic by creating jobs, addressing climate change, and improving housing stability for struggling households. Click here for bill text.

- The Ending Homelessness Act of 2021 would end homelessness and significantly reduce poverty in America by transforming the Housing Choice Voucher program into a federal entitlement, so that every household who qualifies for assistance would receive it. The lead cosponsors of this bill are Representative Emanuel Cleaver (D-MO) and Representative Ritchie Torres (D-NY). Click here for bill text.

- The Downpayment Toward Equity Act of 2021 would help address the U.S. racial wealth and homeownership gaps by providing $100 billion toward downpayment and other financial assistance for first-generation homebuyers to purchase their first home. The lead cosponsors of this bill are Representative Al Green (D-TX), Representative Ayanna Pressley (D-MA), Representative Jesús “Chuy” García (D-IL), Representative Cindy Axne (D-IA), and Representative Sylvia Garcia (D-TX). Click here for bill text.

See below for legislative fact sheets.

Housing is Infrastructure Act of 2021

The Ending Homelessness Act of 2021

The Downpayment Toward Equity Act of 2021

###

Subcommittee Hearings

Subcommittee on Consumer Protection and Financial Institutions - Banking the Unbanked: Exploring Private and Public Efforts to Expand Access to the Financial System

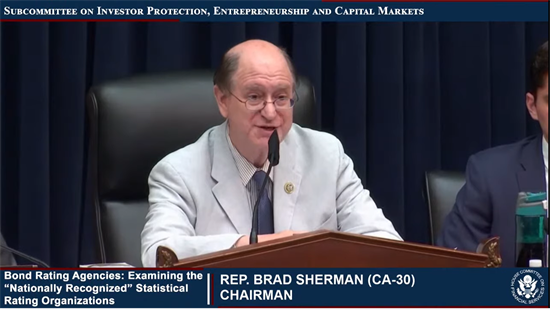

Subcommittee on Investor Protection, Entrepreneurship and Capital Markets - Bond Rating Agencies: Examining the “Nationally Recognized” Statistical Rating Organizations

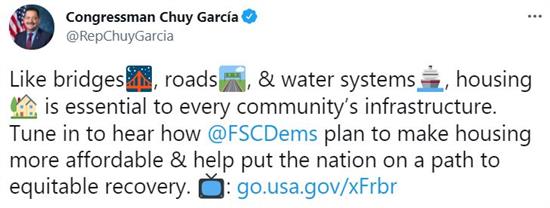

Tweets of the Week

###

|

|

Member Spotlight

| Congresswoman Alexandria Ocasio-Cortez (D-NY) |

Congresswoman Alexandria Ocasio-Cortez (D-NY) serves as on the Subcommittee on National Security, International Development and Monetary Policy and introduced a discussion draft of the “Public Banking Act of 2021,” which was considered during this week’s hearing entitled, “Banking the Unbanked: Exploring Private and Public Efforts to Expand Access to the Financial System.”

###

Weekend Reads

July Committee Calendar Updates

-

July 27 at 10:00 AM ET: The Subcommittee on National Security, International Development and Monetary Policy will convene for an in-person hearing entitled, “The Promises and Perils of Central Bank Digital Currencies.”

-

July 27 at 2:00 PM ET: The Subcommittee on Housing, Community Development and Insurance will convene for an in-person hearing entitled, “NAHASDA Reauthorization: Addressing Historic Disinvestment and the Ongoing Plight of the Freedmen in Native American Communities.”

-

July 28 at 10:00 AM ET: The full Committee will convene for a hybrid markup.

All hearings are livestreamed on https://democrats-financialservices.house.gov/live/.

For virtual hearings, all Members and witnesses participate remotely with no in-person hearings participation in the hearing room. In-person will take place in 2128 Rayburn House Office Building.

Committee activities are finalized once an official notice is issued by the House Financial Services Committee. Visit https://democrats-financialservices.house.gov/calendar/ for the most up-to-date Committee schedule.

###

Waters at Hearing on Oversight of HUD: Key to Building Back Better, and More Equitably, Is Understanding That Housing Is Infrastructure

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, gave the following statement at a full Committee hybrid hearing entitled, “Building Back A Better, More Equitable Housing Infrastructure for America: Oversight of the Department of Housing and Urban Development.”

First of all, a happy good morning, Secretary Fudge. I am so delighted to have you with us today to discuss the work that the Biden Administration is doing to build a more fair, equitable, and accessible housing infrastructure in this country.

I want to begin by applauding you and the Biden Administration for treating our housing crisis with the urgency and seriousness it deserves. The Trump Administration made it crystal clear that it didn’t appreciate the magnitude of our nation’s housing crisis. By repeatedly proposing deep budget cuts to HUD programs and taking action to undermine our fair housing laws, the Trump Administration showed a complete disregard for low- and moderate-income families, people of color, the LGBTQ-plus community, and immigrants.

It’s only because of Democrats in Congress that HUD’s budget was not decimated during Trump’s presidency. Because elections matter, President Biden and HUD have now begun to reverse Trump’s anti-fair housing rules.

Democrats on this Committee also remain laser-focused on ensuring that eligible families receive the housing assistance available to them through the CARES Act, the December relief package, the American Rescue Plan, and other coronavirus relief legislation…

Click here to read her opening statement.

###

Waters on Bond Rating Agencies: Investors Need Objective and Reliable Ratings More Than Ever

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, gave the following statement at a Subcommittee on Investor Protection, Entrepreneurship and Capital Markets hybrid hearing entitled, “Bond Rating Agencies: Examining the “Nationally Recognized” Statistical Rating Organizations.”

Thank you, Mr. Sherman.

In the lead up to the 2008 financial crisis, the bond rating agencies assigned triple-A ratings to worthless mortgage-backed securities and complex products created by Wall Street, all the while knowing that retirees, cities and towns, and investors around the world relied on their ratings to make investment decisions. Their ratings brought our financial system to its knees — millions of people lost their jobs, their homes, and their life savings, not to mention costing the economy trillions of dollars.

Eleven years later, many of the Dodd-Frank reforms for rating agencies remain unfinished, including addressing a central conflict of interest wherein the same companies selling securities continue to shop around for their preferred rating. With the financial risks that climate change and the pandemic now pose, investors need objective and reliable ratings more than ever. So, I look forward to this discussion, and I want to thank Mr. Sherman for putting the time and attention on this issue that’s certainly needed. We are looking forward to seeing how we can improve this critical part of our capital markets.

###

Chairwoman’s Corner

Waters on Expanding Access to the Financial System: Having Access to a Bank Account Is Fundamental to Financial Security

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, gave the following statement at a Subcommittee on Consumer Protection and Financial Institutions hybrid hearing entitled, “Banking the Unbanked: Exploring Private and Public Efforts to Expand Access to the Financial System.”

Thank you, Chair Perlmutter.

I am pleased that this hearing focuses on access to banking services, especially for communities in banking deserts without a nearby branch to go to. In the Los Angeles area, the rate of unbanked households is higher than the national rate, and the unbanked are disproportionately lower-income households of color.

Having access to a bank account is fundamental to financial security. Millions of Americans who did not have a bank account during this pandemic had to wait weeks or months to receive stimulus checks while they struggled to afford housing, to take care of their loved ones, and otherwise make ends meet. Wall Street megabanks have mistreated unbanked individuals for long enough. Our constituents in California, Colorado, New York, and across the country are fed up and are advocating for new consumer-centered solutions, such as no-fee FedAccounts and public banking.

I look forward to the testimony from our witnesses, and I yield back.

###

|