|

Waters Opening Statement at Hearing on Housing Resiliency in the Face of Climate Change

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, gave the following opening statement at a Subcommittee on Housing, Community Development and Insurance virtual hearing entitled, “Built to Last: Examining Housing Resilience in the Face of Climate Change.”

Thank you very much, Chairman Cleaver for convening this hearing on the need to improve the resiliency of our country’s housing infrastructure in the face of climate change. In recent years, the United States has experienced more frequent and intense natural disasters attributable to climate change, displacing tens of thousands of people and costing hundreds of billions of dollars in damage. I’ve been working across Congresses now with Members on both sides of the aisle to reform the National Flood Insurance Program, and I’m looking forward to passing further reforms as well as making a significant investment in our nation’s affordable housing stock by passing the Housing is Infrastructure Act as part of President Biden’s American Jobs Plan. So, I want to thank you so very much for the attention you are giving to this issue.

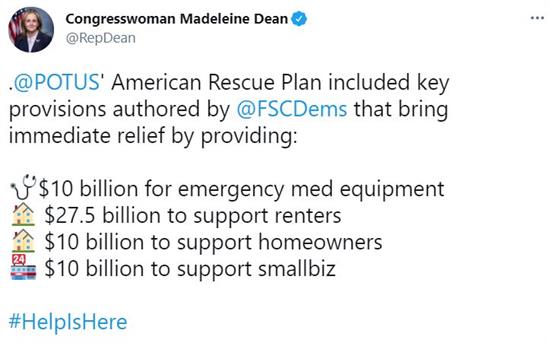

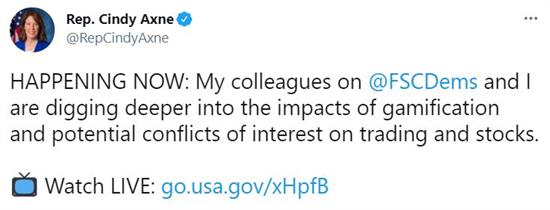

Tweets of the Week

|

|

Member Spotlight

| Congressman Bill Foster (D-IL) |

This week, Congressman Bill Foster (D-IL), Chair of the Task Force on Artificial Intelligence, chaired his first hearing of the Task Force in the 117th Congress.

Watch the virtual hearing, entitled “Equitable Algorithms: How Human-Centered AI Can Address Systemic Racism and Racial Justice in Housing and Financial Services,” here.

Weekend Reads

Waters at Third Hearing on Ongoing Market Volatility: This Committee Is Focused on Ensuring Accountability for Wall Street

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, gave the following statement at a full Committee virtual hearing entitled, “Game Stopped? Who Wins and Loses When Short Sellers, Social Media, and Retail Investors Collide, Part III.”

Today, this Committee convenes for part three of our series of hearings focused on market volatility related to GameStop and other stocks.

In our first hearing on those events, we received testimony from the CEOs of trading app Robinhood, Wall Street firms Citadel and Melvin Capital, and social media company Reddit, as well as Keith Gill, a trader involved in the WallStreetBets subreddit. We heard directly from those involved in the short squeeze and volatility and we got the facts.

In our second hearing, we received testimony from a number of capital markets experts and investor advocates, to hear their views and begin to assess possible legislative and regulatory steps that may be necessary.

We have examined conflicts of interest in the market. We have scrutinized payment for order flow, potential systemic risks to our financial system, the gamification of trading, the clearance and settlement process for trades, and the evolution of trading with the rising use of social media and new technologies.

Today, we will focus on the regulatory response to the market volatility. Specifically, we will hear testimony from the Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), and the Deposit Trust and Clearing Corporation (DTCC) about their responses to events we are examining.

Click here to read her full statement.

Chairwoman’s Corner

Waters Calls on Appropriators to Fund Affordable Housing, Community Development Lending and Investments, Investor Protections and Homelessness Assistance

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Financial Services Committee, sent letters to senior Members of the House Committee on Appropriations urging them to fund the Minority Business Development Agency, the Community Development Financial Institutions (CDFI) Fund, the Securities and Exchange Commission (SEC), and programs that support affordable housing and address homelessness within the U.S. Department of Housing and Urban Development.

Chairwoman Waters sent letters to the Committee on Appropriations as follows:

- To fund Minority Business Development Agency (MBDA), which is focused on the unique needs of minority business enterprises. See the full text of the letter here.

- To fund the Community Development Financial Institutions (CDFI) Fund and the Community Development Revolving Loan Fund, with set asides for minority lending institutions and minority depository institutions. See the full text of the letter here.

- To fund the Rural Housing Service of the U.S. Department of Agriculture, which provides relief for thousands of rural residents who may otherwise face significant rent increases or displacement. See the full text of the letter here.

- To fund the U.S. Department of Housing and Urban Development’s direct rental assistance programs: public housing, the Section 8 Housing Choice Voucher (HCV) and Project-Based Rental Assistance (PBRA) programs, the Section 202 Supportive Housing for the Elderly program (Section 202), and the Section 811 Supportive Housing for People with Disabilities program. See the full text of the letter here.

- To fund the Community Development Block Grant (CDBG) program, one of the most effective programs for growing local economies. See the full text of the letter here.

- To fund the U.S. Department of Housing and Urban Development’s McKinney Vento Homeless Assistance Grants in FY2022, Housing Choice Vouchers, and new permanent supportive housing to address homelessness. See the full text of the letter here.

- To fund the Securities and Exchange Commission (SEC), which is tasked with the important mission to protect investors; maintain fair, orderly, and efficient capital markets; and facilitate capital formation. See the full text of the letter here.

|