|

Subcommittee on Housing, Community Development and Insurance Convenes Hearing on Insuring Against a Pandemic

On Thursday, the Subcommittee on Housing, Community Development, and Insurance held a virtual hearing entitled, “Insuring against a Pandemic: Challenges and Solutions for Policyholders and Insurers.”

The virtual hearing witnesses included:

- Ann Cantrell, Owner, Annie’s Blue Ribbon General Store, on behalf of the National Retail Federation

- John Doyle, President & Chief Executive Officer, Marsh

- Brian Kuhlmann, Chief Corporate Counsel, Shelter Insurance, on behalf of APCIA and NAMIC

- Michelle Menendez McLaughlin, Chief Underwriting Officer, Chubb North America

- R.J. Lehmann, Executive Editor and Senior Fellow, International Center for Law and Economics

Click here to watch the virtual roundtable.

Tweets of the Week

|

|

Member Spotlight

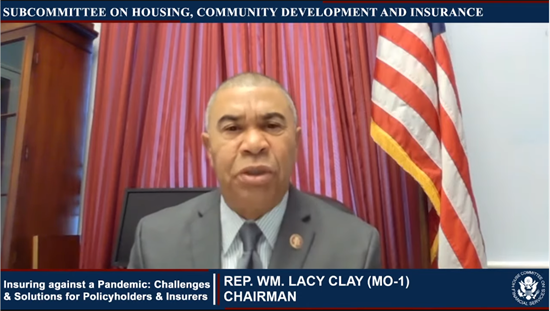

| Rep. Wm. Lacy Clay (D-MO) |

This week, Congressman Wm. Lacy Clay (D-MO), Chairman of the Subcommittee on Housing, Community Development and Insurance, chaired a virtual hearing entitled, “Insuring against a Pandemic: Challenges and Solutions for Policyholders and Insurers.”

Watch the virtual hearing here:

Waters Warns That Small Businesses May Permanently Close Due to COVID-19 if Action Is Not Taken Soon

On Thursday, Chairwoman Maxine Waters (D-CA), gave the following statement at a Subcommittee on Housing, Community Development, and Insurance virtual hearing entitled, “Insuring against a Pandemic: Challenges and Solutions for Policyholders and Insurers.”

“Thank you very much Chairman Clay. When the COVID-19 pandemic hit in March, small businesses were devastated, and have been largely unable to rely on their business interruption insurance policies to cover these losses. As we enter the winter months, economic forecasters are warning that small businesses—many of which have not recovered from the disruption they have experienced already this year—may permanently close if policymakers don’t act.

“Congress has an important role to play, but with the election of President-elect Biden, I’m hopeful the government will respond to this pandemic with effective leadership, which has been, and continues to be, absent under the current President ….”

See the full text of her statement here.

Waters Statement on Proposed Acquisition of BBVA USA by PNC

On Wednesday, Chairwoman Maxine Waters (D-CA), made the following statement on the news that PNC Financial Services Group, Inc. (“PNC”) plans to acquire BBVA USA Bancshares.

“The proposed acquisition of BBVA USA Bancshares by PNC would create the fifth largest bank in the United States. For far too long, regulators and the Department of Justice have rubber-stamped these kind of mergers. I and other Democrats have repeatedly warned that the Trump Administration’s deregulatory actions would result in a wave of mergers and bank consolidation and now here we are, one year after the approval of the BB&T-SunTrust merger, with another megabank in the making. This month, the American public resoundingly rejected Trump’s harmful deregulatory agenda by voting for President-elect Biden….”

See the full text of the statement here.

Weekend Reads

Chairwoman’s Corner

Chairwoman Waters Blasts the Trump Administration’s Move to Shut Down Key CARES Act Facilities Put in Place to Support Economy During the Pandemic

Chairwoman Maxine Waters (D-CA) blasted the Trump Administration for the announcement that it is attempting to shut down key emergency lending programs created by the CARES Act to support the economy during the COVID-19 pandemic:

“It is clear that Trump and Mnuchin are willing to spitefully destroy the economy and make it as difficult as possible for the incoming Biden Administration to turn this crisis around and lead the nation to a recovery. Congress approved $500 billion in funding to support a series of emergency lending facilities run by the Federal Reserve and Treasury to stabilize the economy during the pandemic, which continues to surge across the nation. As COVID-19 cases spike, these facilities need to be extended. There is no justifiable reason to shut these facilities down.

“Without support from the Main Street Lending Program, millions of small businesses are at risk of permanent closure. Without the Fed’s corporate credit facilities, financial markets will suffer as corporations start to fail at higher rates. And without the Municipal Liquidity Facility, states, local communities, transit agencies, and hospitals on the front lines of fighting the virus will face higher borrowing costs. We are nowhere near out of the woods, and it is deeply irresponsible for Secretary Mnuchin to assert otherwise….”

Click here to read her full statement.

|