|

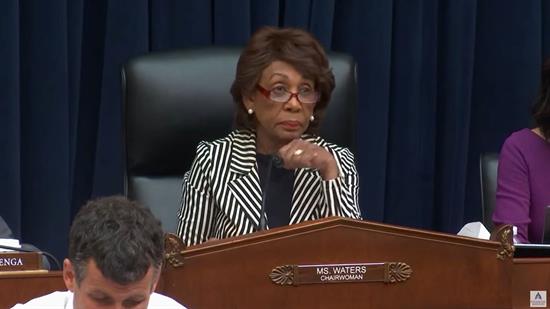

Waters Opening Statement at May Full Committee Markup

This week, Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, gave the following opening statement at a full Committee markup.

This Congress, I am so very proud of how Committee Democrats have consistently pushed legislation that reflects our values: bills that put consumers first despite opposition from highly paid lobbyists and big corporations; that invest in communities and people who have been left behind; and then work to keep our economy safe.

Today, Committee Democrats are again focusing on protecting and expanding financial access, promoting community development, and caring for those experiencing homelessness. Accordingly, we will markup my bill, H.R. 7003, the “Expanding Financial Access for Underserved Communities Act,” which would allow credit unions to serve communities that have been determined to lack access to capital…

Read the full statement HERE.

|

|

|

Member Spotlight

| Congresswoman Cindy Axne (D-IA) |

Congresswoman Cindy Axne (D-IA) serves as Vice Chair of the Subcommittee on Housing, Community Development and Insurance, and also serves on the Subcommittee on Investor Protection, Entrepreneurship and Capital Markets. This week, Rep. Axne’s bill, the “Flexibility in Addressing Rural Homelessness Act” (H.R. 7196), passed the Committee with a bipartisan voice vote. The bill would allow homeless service providers in rural communities to use funds from HUD’s Continuum of Care program for additional activities to increase their capacity and address the unique challenges they face when serving people experiencing homelessness.

Weekend Reads

###

Markup Highlights

Committee on Financial Services Passes Eight Bills to Keep Up with Evolving Financial Marketplace, Stand Up for Vulnerable Communities

This week, the House Financial Services Committee, led by Chairwoman Maxine Waters (D-CA), passed eight bills to keep up with an ever-changing marketplace by modernizing our regulatory framework, closing loopholes and ensuring robust oversight, along with bills to promote financial inclusion, expand access to affordable financial services, promote impactful community development and care for those experiencing homelessness.

- H.R. 7734, the Timely Delivery of Bank Secrecy Act Reports Act is a bill offered by Chairwoman Maxine Waters (D-CA).

- Passed the Committee by a voice vote.

- H.R. 7733, the CDFI Bond Guarantee Program Improvement Act of 2022 is a bill offered by Representative Emanuel Cleaver (D-MO).

- Passed the Committee by a voice vote.

- H.R. 7732, the Strengthening the Office of Investor Act is a bill offered by Representative Stephen Lynch (D-MA) .

- Passed the Committee by 25-22.

- H.R. 7022, the Strengthening Cybersecurity for the Financial Sector Act of 2022 is a bill offered by Representative Bill Foster (D-IL).

- Passed the Committee by 24-22.

- H.R. 7716, the Coordinating Substance Use and Homelessness Care Act of 2022 is a bill offered by Representative Madeleine Dean (D-PA).

- Passed the Committee by 27-22.

- H.R. 7196, the Flexibility in Addressing Rural Homelessness Act is a bill offered by Representative Cindy Axne (D-IA).

- Passed the Committee by a voice vote.

- H.R. 4395, the Payment Choice Act of 2022 is a bill by Representative Donald Payne (D-NJ) (introduced in Committee by Representative Sylvia Garcia (D-TX)) .

- Passed the Committee by 32-17.

- H.R. 7003, the Expanding Financial Access for Undeserved Communities Act is a bill offered by Chairwoman Maxine Waters (D-CA)

- Passed the Committee by 27-22.

See here for the full description of the bills and markup.

###

Upcoming Committee Dates

- Tuesday, May 24 at 12:00 PM ET: The Subcommittee on Diversity and Inclusion will convene for a virtual hearing entitled, “Diversity Includes Disability: Exploring Inequities in Financial Services for Persons with Disabilities, Including Those Newly Disabled Due to Long-Term COVID.”

- Wednesday, May 25 at 12:00 PM ET: The Subcommittee on Housing, Community Development and Insurance will convene for a virtual hearing entitled, “Reauthorization and Reform of the National Flood Insurance Program.”

- Thursday, May 26 at 12:00 PM ET: The full Committee will convene for a virtual hearing entitled, “Digital Assets and the Future of Finance: Examining the Benefits and Risks of a U.S. Central Bank Digital Currency.”

Chairwoman’s Corner

Waters Urges President Biden to Cancel $50,000 of Student Loan Debt for Each Borrower to Help Close Racial Wealth Gap

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Financial Services Committee sent a letter to President Biden urging him to cancel $50,000 in student debt for each borrower without delay, which would provide much needed relief to millions of borrowers-- especially Millennial, Gen Z, and borrowers of color-- who are unable to realize major life milestones due to the burden of student debt.

“I am writing to follow up on my letter to you on December 4, 2020, when you were President-elect, to again urge you to promptly cancel $50,000 of student loan debt for all federal student loan borrowers,” wrote Chairwoman Waters. “Borrowers of color are especially burdened by student loan debt, with Black college graduates owing an average of $25,000 more in student loan debt than their White peers. And even when borrowers make timely payments on their loans, the overall balance of debt can go up rather than down due to things like interest accrual and faulty loan servicing. Again, Black borrowers are disproportionately impacted by this phenomenon. For example, four years after graduation, nearly half of Black borrowers owe an average of 12.5 percent more than they borrowed... The people of this country need your decisive action to cancel $50,000 of student loan debt for all federal student loan borrowers.”

On September 10, 2019, Chairwoman Waters convened hearing of the House Financial Services Committee entitled, “A $1.5 Trillion Crisis: Protecting Student Borrowers and Holding Student Loan Servicers Accountable.”

On December 4, 2020, Chairwoman Waters recommended President Biden issue an executive order to promptly forgive up to $50,000 of debt for each federal student loan borrower and pause all student loan payments and interest accrual until the economy can recover.

On December 17, 2020, Chairwoman Waters joined Congresswoman Ayanna Pressley in introducing a resolution urging the President to cancel up to $50,000 in Federal student loan debt for student loan borrowers using existing legal authority under the Higher Education Act. On February 4, 2021, Chairwoman Waters joined Congresswoman Ayanna Pressley to reintroduce the resolution.

See the full text of the letter HERE.

|