|

Waters to Kraninger: America Needs Better From You

On Thursday, Congresswoman Maxine Waters (D-CA), Chairwoman of the House Financial Services Committee, convened a hearing entitled, “Protecting Consumers or Allowing Consumer Abuse? A Semi-Annual Review of the Consumer Financial Protection Bureau.” During the hearing Kathy Kraninger, Director of the Consumer Financial Protection Bureau, provided testimony on the Consumer Bureau’s semiannual report to Congress.

See the Chairwoman’s opening statement here.

|

|

As Seen on FSC-TV

In case you missed this week’s hearings, see below for a snippet of the infographics displayed on the hearing room big screens.

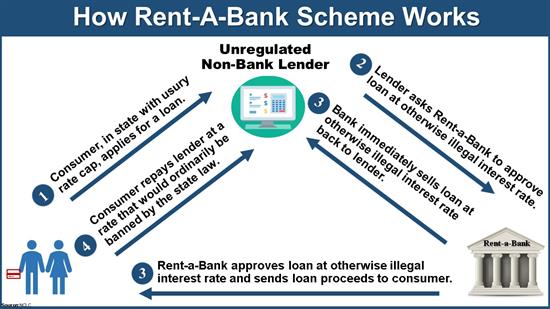

February 5: Full Committee Hearing on Rent-A-Bank Schemes and Debt Traps.

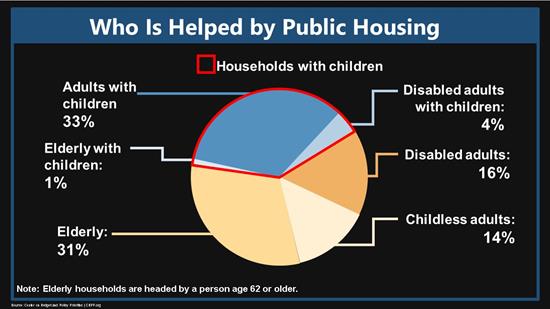

February 5: Subcommittee Hearing on Public Housing.

February 6: Full Committee Hearing on the Semi-Annual Review of the Consumer Bureau.

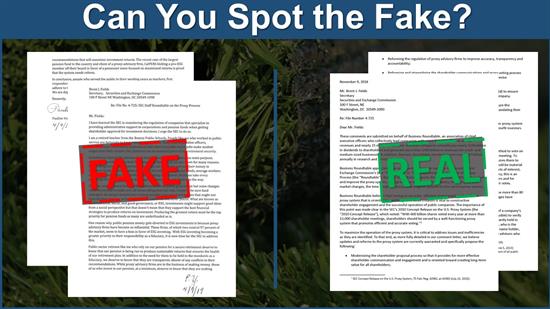

February 6: Subcommittee Hearing on Astroturfing.

|

|

Member Spotlight

| Congressman Chuy Garcia (D-IL) |

"Strong majorities of Democratic, Republican and independent registered voters support a federal cap on interest rates that could pass the House later this year, according to poll results shared Tuesday with The Hill. Seventy percent of registered voters said they approved of limiting interest rates on consumer loans to 36 percent….– The Hill on the Veterans and Consumers Fair Credit Act, legislation introduced by Rep. Chuy Garcia to prevent debt traps by imposing cap protections on loan interest rates.

Tweet of the Week

Weekend Reads

Chairwoman's Corner

Protecting the Volcker Rule: On Monday, Chairwoman Waters issued a statement on yet another attempt by prudential regulators to weaken the Volcker Rule. See below for a snippet of what she had to say.

“In August, regulators senselessly weakened the proprietary trading section of this critical rule. Today, they are proposing to allow banks to invest in the same risky assets that contributed heavily to the financial crisis and to become more entangled in private equity and hedge funds.

“At a time when prudential regulators should be working to uphold consumer protections, we continue to see a series of deregulatory actions by Trump appointees that benefit Wall Street at the expense of Main Street."

Click here for the full statement.

|