|

Following Supreme Court Decision: Waters Welcomes Resignation of Federal Housing Finance Agency Director Mark Calabria

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, released the following statement on the U.S. Supreme Court’s decision on Presidential authority to remove Federal Housing Finance Agency Director, Mark Calabria.

“Today, the United States Supreme Court ruled that President Biden has the authority to fire Mark Calabria, Director of the Federal Housing Finance Agency (FHFA). As the Trump-appointed FHFA Director, Mr. Calabria has been an ideologue, putting his own beliefs and shareholder priorities ahead of those of hardworking families seeking the dream of homeownership through fair and affordable mortgage lending. It is time for him to go.

“In November 2020, the American public made its voice heard, and President Biden has my full support as Chairwoman of the House Committee on Financial Services in exerting his authority to remove Mr. Calabria immediately. During the current economic downturn, the American people need an FHFA Director who will make it their top priority to focus on pandemic response and equitable recovery efforts to keep families in their homes and expand equitable access to affordable credit…”

Click here to read her full remarks statement.

###

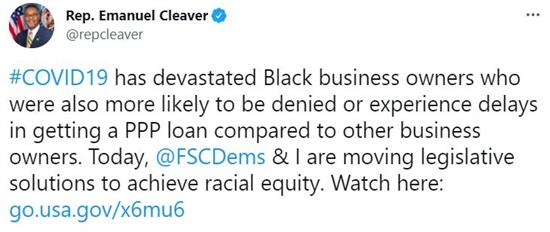

Tweets of the Week

|

|

Member Spotlight

| Congressman Jesus “Chuy” Garcia (D-IL) |

This week, the House of Representatives passed the Senate Joint Resolution 15, a resolution that invalidates the Trump Administration’s “True Lender” rule. The House companion was introduced by Representative Jesus “Chuy” Garcia (D-IL) and passed the House by a vote of 218-208. Representative Garcia serves on the Subcommittee on National Security, International Development and Monetary Policy and the Subcommittee on Oversight and Investigations for the 117th Congress.

Weekend Reads

June Committee Calendar Updates

All hybrid hearings and markups will take place in-person in 2128 Rayburn House Office Building and with a virtual option for all Members and witnesses to participate remotely.

All hearings will be livestreamed on https://democrats-financialservices.house.gov/live/.

Committee activities are finalized once an official notice is issued by the House Financial Services Committee. Visit https://democrats-financialservices.house.gov/calendar/ for the most up-to-date Committee schedule.

###

Committee Passes Legislation Strengthening Protections for Consumers, Minority Owned Businesses, and Credit Unions

This week, the House Financial Services Committee passed four bills focused on establishing protections across the financial system, including codifying the Minority Development Agency to ensure minority-owned companies have the necessary resources, requiring reporting from U.S. Global Systemically Important Banks (G-SIBs) to the Federal Reserve, extending enhancements to the National Credit Union Administration, and updating the Customer Identification Program to accept the municipal IDs to benefit the unbanked and underbanked.

The Committee passed the following bills:

- The Minority Business Resiliency Act (H.R. 2689), a bill by Representative Al Green (D-TX), would supersede Executive Order 11625, which created the original Minority Business Development Agency (MBDA), and codify the agency into law to assist the development and resiliency of minority business enterprises (MBEs). MBEs are defined as firms that are at least 51 percent owned by one or more socially disadvantaged individuals and whose management and daily business operations are controlled by one or more socially disadvantaged individuals. Additionally, this bill establishes business centers in areas that primarily serve rural minority business enterprises.

The bill passed the Committee by a vote of 28-23.

- The Greater Supervision In Banking (G-SIB) Act (H.R. 3948), a bill by Representative Ayanna Pressley (D-MA), would require U.S. Global Systemically Important Banks (G-SIBs) to present detailed annual reports to the Federal Reserve and have them published on its website. The reports will provide details about the G-SIBs’ size and complexity, enforcement actions taken against the G-SIB, executive and worker compensation, support for MDIs and CDFIs, steps being taken to reach climate emissions reduction targets, diversity of the GSIBs’ board, and more.

The bill passed the Committee by a vote of 28-22.

- The Central Liquidity Facility Enhancement Act (H.R. 3958), a bill by Representative Maxine Waters (D-CA), would permanently extend enhancements for the National Credit Union Administration’s (NCUA) Central Liquidity Facility (CLF) made in the CARES Act that expanded access to liquidity support for more credit unions, especially small credit unions. The bill would also require a GAO study to analyze the impact of the enhancements.

The bill passed the Committee by a vote of 28-22.

- The Municipal I.D.'s Acceptance Act (H.R. 3968), a bill by Representative Ritchie Torres (D-NY), would direct the federal financial regulators and the Financial Crime Enforcement Network (FinCEN) to update the guidance on the Customer Identification Program (CIP) to clarify that banks may incorporate municipal-issued identification (ID) into the financial institution’s risk-based approach.

The bill passed the Committee by a vote of 27-23.

###

Chairwoman’s Corner

Waters Applauds Biden Administration Announcement of Final Extension of Federal Eviction and Foreclosure Moratoria

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, released the following statement on the Biden Administration’s decision to extend the eviction and foreclosure moratoria until July 31, 2021 bringing much needed relief to renters and homeowners during a time of recovery.

“Today, the Biden Administration announced an extension to July 31, 2021 of both the eviction and foreclosure moratoria, which were set to expire on June 30, as well as other necessary federal actions. This is the right thing to do to prevent increases in homelessness as Congress and the administration work together to ensure pandemic housing relief provided by Congress, including $46.6 billion in emergency rental assistance and $10 billion in homeowner assistance, reaches households in need. While I recognize the reality that landlords, particularly small mom-and-pop landlords, need to collect rent to cover their mortgage payments and other costs, extending the moratoria until local communities can distribute this relief will be the difference between millions of families losing or remaining in their homes. We must not forget the economic events that have brought us to our current day situation. In the aftermath of the 2008 financial crisis, millions of families lost their homes to mass foreclosures. I commend the administration for its extension of the foreclosure moratorium, and it is now in the hands of the Consumer Financial Protection Bureau to ensure its rulemaking on mortgage servicing requirements is finalized and effective by the end of July to avoid any gaps in protections for homeowners. If we do not learn from our mistakes of the past and act in the greatest interest of everyday people, our nation stands to lose another generation of homeowners and experience an exacerbation of our current homelessness and affordable housing crises. I commend the Biden Administration for its ‘all-of-government’ approach to keep people safely in their homes.”

###

|