|

Committee Holds Virtual Roundtable Examining the Impact of COVID-19 on U.S. Capital Markets

On Tuesday, the Subcommittee Investor Protection, Entrepreneurship and Capital Markets, held a virtual roundtable with housing experts entitled, “Examining the Impacts of the COVID-19 Pandemic on U.S. Capital Markets.”

The virtual roundtable panelists included:

- Christopher Gerold, North American Securities Administrators Association and Bureau Chief of the New Jersey Bureau of Securities

- Heather Slavkin Corzo, Head of U.S. Policy, Principles for Responsible Investment

- Brett Palmer, President, Small Business Investor Alliance

- Tom Quaadman, Executive Vice President, U.S. Chamber Center for Capital Markets Competitiveness

Watch the virtual roundtable discussion here.

|

|

Weekend Reads

|

|

Tweet of the Week

|

|

|

Member Spotlight

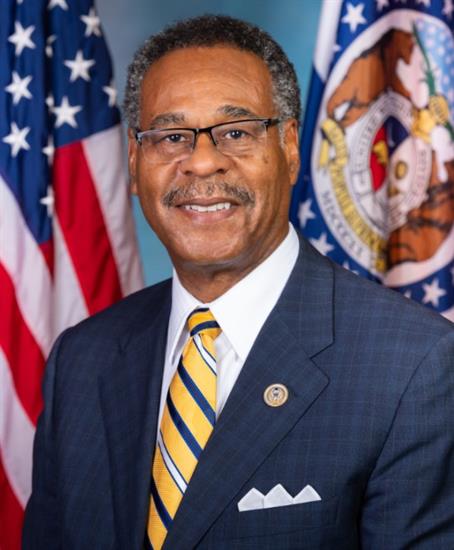

| Congressman Emanuel Cleaver (D-MO) |

This week, the Congressman Emanuel Cleaver (D-MO), Chairman of the House Committee on National Security, International Development and Monetary Policy, cohosted a virtual roundtable entitled, “Understanding the Cyber Threats and Actors Exploiting the COVID-19 Crisis.”

Watch the virtual roundtable discussion here.

Chairwoman’s Corner

This week, Congresswoman Maxine Waters (D-CA), Chairwoman of the House Financial Services Committee, made the following statement regarding the U.S. Department of the Treasury and Small Business Administration’s (SBA) announcement that it is setting aside $10 billion in Paycheck Protection Program (PPP) funds to be distributed by Community Development Financial Institutions (CDFIs).

“I am very pleased that Treasury and SBA have taken this step, which I, Speaker Pelosi, Chairwoman Velázquez, and other Democratic leaders have called for, of setting aside $10 billion in Paycheck Protection Act funds for Community Development Financial Institutions (CDFIs) to lend.

“I urge the Treasury Department and SBA to now take the same step of setting aside $10 billion PPP funds for Minority Depository Institutions (MDIs) to lend. MDIs play a key role in providing access to credit in minority communities, and it is critical that additional PPP funds be dedicated for lending by these institutions.”

See the full text of the release here.

|