Member Spotlight

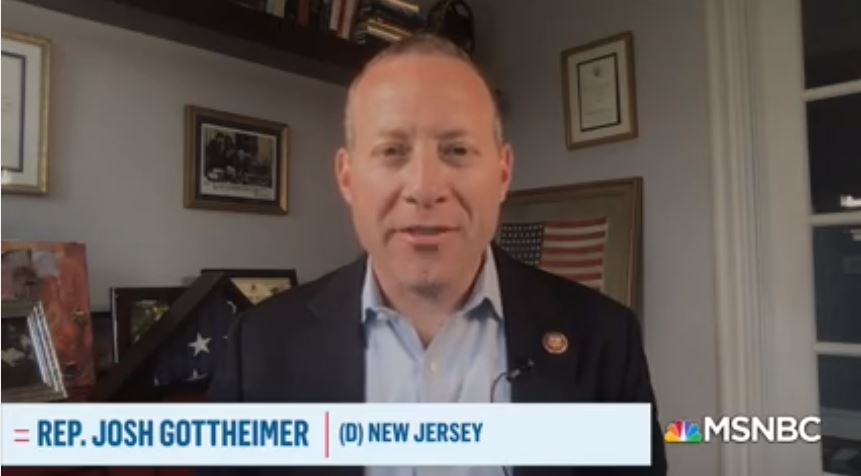

| Congressman Josh Gottheimer (D-NJ) |

Gottheimer Talks Kodak deal with MSNBC: ‘Nothing about this is right’

On Thursday, Congressman Gottheimer (D-NJ), joined MSNBC’s Stephanie Ruhle to discuss his letter with Chairwoman Waters (D-CA,) Subcommittee Chair Sherman (D-CA,) and Task Force Chair Lynch (D-MA) urging the Securities and Exchange Commission (SEC) to investigate the transactions surrounding the $765 million proposed deal under the Defense Production Act.

See the full interview here.

Waters, Gottheimer, Sherman, Foster, and Lynch Lead Call For SEC Investigation into Kodak; Cite Concern Over Insider Trading Related to Defense Production Act Deal

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, Congressman Josh Gottheimer (D-NJ), Congressman Brad Sherman (D-CA), Chairman of the Subcommittee on Investor Protection, Entrepreneurship and Capital Markets, Congressman Bill Foster (D-IL), Chairman of the Task Force on Artificial Intelligence, and Congressman Stephen F. Lynch (D-MA), Chairman of the Task Force on Financial Technology, led a letter to Jay Clayton, Chairman of the Securities and Exchange Commission (SEC) urging the SEC to investigate the transactions surrounding the $765 million proposed deal under the Defense Production Act of 1950 (DPA) between the Trump administration and Eastman Kodak Company (Kodak) amid reports that Kodak’s compensation board issued $1.75 million in stock options to Jim Continenza, the company’s Executive Chairman and Chief Executive Officer. Fueling the Members’ concern about insider training during the COVID-19 pandemic are SEC filings that indicate Continenza and Philippe Katz, a Kodak board member, bought Kodak shares on July 23, 2020 – just days before the DPA loan became public information.

Other signatories of the letter include Representatives Carolyn B. Maloney (D-NY), Nydia M. Velázquez (D-NY), Gregory Meeks (D-NY), Emanuel Cleaver (D-MO), Katie Porter (D-CA), and Cindy Axne (D-IA).

“Our concerns regarding insider trading during the COVID-19 pandemic have only been heightened by our serious concerns arising from a series of securities transactions engaged in by Eastman Kodak Company (Kodak), its executive officers and its board members,” wrote the Members. “These transactions seem to have taken place at, or around, the time Kodak learned it could be eligible to receive a $765 million loan under the Defense Production Act of 1950 (DPA). Notably, the loan was awarded to Kodak to manufacture generic drugs in the United States, despite Kodak’s limited experience in the pharmaceutical industry.”

See the full text of the letter.

Weekend Reads

Waters, Warren and Gillibrand Introduce Legislation Requiring the Fed to Close Racial Employment and Wage Gaps

On Wednesday, Congresswoman Maxine Waters (D-CA), Chairwoman of the House Financial Services Committee, Senator Elizabeth Warren (D-MA), Ranking Member of the Senate Banking, Housing, and Urban Affairs Committee Subcommittee on Financial Institutions and Consumer Protection, and Senator Kirsten Gillibrand (D-NY), introduced legislation to require the Federal Reserve to use its existing authorities to close racial employment and wage gaps and report on how the gaps change over time.

“Building on the great work of civil rights leader Coretta Scott King and others who led the way for the adoption of the Fed’s full employment mandate, the Federal Reserve Racial and Economic Equity Act creates a new racial justice mission at the Fed to eliminate racial and economic disparities in all of its work. This bill also requires the Fed to report and testify on their efforts to fulfill this mandate and provide data on racial economic disparities,” said Chairwoman Waters. “As the COVID-19 pandemic crisis and its economic impacts disproportionately affect communities of color, and communities around the country march in the streets for justice, the Federal Reserve must do everything it can to ensure the recovery is equitably shared.”

The Federal Reserve Racial and Economic Equity Act:

- Makes Reducing Inequality Part of the Fed’s Mission: This bill adds a new section to the Federal Reserve Act that would require the Fed to carry out its functions in a way that “minimizes and eliminates racial disparities in employment, wages, wealth, and access to affordable credit.”

- Ensures that Racial Economic Disparities are Not Ignored: This legislation requires the Federal Reserve Chair to identify in his or her semiannual testimony before Congress: (1) the existing disparities in employment, income and wealth across racial and ethnic groups and (2) how the Fed is using its authorities to reduce these disparities.

- Requires Robust Reporting on Disparities in Labor Force Trends: This bill requires the Fed’s Semiannual Monetary Policy Report that the Fed releases in conjunction with the Chair’s testimony to include recent labor force trends with “a comparison among different demographic groups, including race, gender, and educational attainment.”

See the full text of the release.

Waters, Engel, Clyburn, Maloney, Green Launch Investigation into $765 Million Deal Between Trump Administration and Kodak

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, Congressman Eliot L. Engel (D-NY), Chairman of the House Committee on Foreign Affairs, Congressman James E. Clyburn (D-SC), Chairman of the House Select Subcommittee on the Coronavirus Crisis, Congresswoman Carolyn B. Maloney (D-NY), Chairwoman of the House Committee on Oversight and Reform, and Congressman Al Green (D-TX), Chairman of the Subcommittee on Oversight and Investigations, sent a letter to Adam Boehler, Chief Executive Officer of the U.S. International Development Finance Corporation (DFC) requesting all documents and communications related to the DFC’s consideration of Eastman Kodak Company (Kodak) for financing under the DFC’s Defense Production Act (DPA) loan program. In the letter, the Members also request all communications between DFC and any private sector entity regarding financing under the DFC’s DPA loan program. Loans made under the program are intended to strengthen the United States’ production of medical supplies and equipment to support the domestic response to the coronavirus pandemic. On July 28, 2020, President Trump announced a deal to award Kodak, a company with little experience producing prescription drugs or their components, a $765 million loan to produce active pharmaceutical ingredients under the DPA.

“On July 28, 2020, you signed a letter of interest to provide $765 million in financing to Eastman Kodak Company (“Kodak”) under DFC’s DPA loan program. According to DFC, the loan would be DFC’s first use of DPA authority and would support Kodak, an organization that was on the brink of failure in 2012 and was unsuccessful in its previous foray into pharmaceutical manufacturing, in its efforts to develop the capacity to produce up to 25 percent of domestic pharmaceutical components,” wrote the Members.

See the full text of the letter.

Chairwoman’s Corner

Chairwoman Waters and Subcommittee Chair Meeks Introduce the “Promoting and Advancing Communities of Color Through Inclusive Lending Act”: On Saturday, Chairwoman Maxine Waters (D-CA) and Congressman Gregory Meeks (D-NY), Chair of the Subcommittee on Consumer Protection and Financial Institutions, introduced the “Promoting and Advancing Communities of Color Through Inclusive Lending Act,” legislation which would build on the Committee’s work to support Community Development Financial Institutions (CDFIs) and Minority Depository Institutions (MDIs) and help to increase affordable lending in minority communities, including to small businesses and minority-owned businesses, which have been hardest hit during the COVID-19 pandemic crisis.

The legislation contains the following provisions:

- Supporting Minority CDFIs. This bill establishes a permanent set aside of 40 percent of CDFI Fund appropriations reserved for award, guarantee, and grant programs for minority lending institutions, and requires reporting on such activities. The bill also establishes a new Office of Minority Community Development Financial Institutions to administer these funds led by a new Deputy Director of Minority Community Development Financial Institutions.

- Emergency Funding to the CDFI Fund. This bill would allocate $5 billion to the CDFI Fund, with $2 billion (40 percent) reserved for minority CDFIs, utilizing existing funds provided under the CARES Act.

- Strengthening MDIs and Impact Banks. The bill strengthens MDIs, as well as “impact banks” that predominantly serve low-income borrowers, through partnerships, investments, technical assistance, and Federal government deposits.

- Expanding Opportunity for MDIs. The bill would codify the Financial Agent Mentor-Protégé Program within the Department of the Treasury. The program provides participating minority depository institutions and small financial institutions with mentorship opportunities with larger financial institutions.

- Capital Investments and Loans to CDFIs and MDIs. This bill directs the Department of Treasury to provide capital and interest-free loans to CDFIs, MDIs, impact banks, and credit unions who primarily serve low-income, underserved communities.

- Provides CDFIs Easier Access to Long-Term Financing. This bill temporarily lowers the minimum issuance amounts under the CDFI Bond Guarantee Program from $100 million to $25 million, and then revises it permanently to $50 million to support community development projects in low-income urban and rural communities.

See here for the bill text.

See here for a one pager.

See here for a section-by-section.

See the full text of the release.