|

Waters and Green Spotlight

“The Real Wells Fargo”

On Wednesday, Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, and Congressman Al Green (D-TX), Chairman of the Subcommittee on Oversight and Investigations, released a Majority staff report entitled, “The Real Wells Fargo: Board & Management Failures, Consumer Abuses, and Ineffective Regulatory Oversight.”

This report is a result of a one-year Committee investigation into Wells Fargo’s compliance with five regulatory orders issued in response to the company’s widespread consumer abuses and compliance breakdowns.

Click here to view the report and see below for some of the report’s highlights covered in the news this week.

|

|

House Passes Four Bipartisan FSC Bills

On Monday, the U.S. House of Representatives passed bipartisan financial services bills to protect servicemembers from predatory debt collectors, improve the availability of affordable housing and mortgage credit, and address concerns that China is trapping developing nations in a cycle of predatory debt. The bills passed include:

- The Fair Debt Collection Practices for Servicemembers Act (H.R. 5003), a bill by Congresswoman Madeleine Dean (D-PA), which passed by a unanimous vote of 355-0.

- The Ensuring Chinese Debt Transparency Act (H.R. 5932), a bill introduced by Congressman French Hill (R-AR), which passed by a unanimous vote of 356-0.

- The Yes in My Backyard Act (H.R. 4351), a bill introduced by Congressman Denny Heck (D-WA), which passed by voice vote.

- The Improving FHA Support for Small Dollar Mortgages Act (H.R. 5931), a bipartisan bill introduced by Congressman Wm. Lacy Clay (D-MO), Chairman of the Subcommittee on Housing, Community Development and Insurance, and Congressman Steve Stivers (R-OH), Ranking Member of the Subcommittee on Housing, Community Development and Insurance, which passed by a voice vote.

Click here to learn more.

Tweet of the Week

Weekend Reads

Chairwoman’s Corner

Proactive Diversity and Inclusion Efforts: On Friday, Chairwoman Waters thanked Visa Incorporated for their efforts to proactively provide the Committee with their diversity and inclusion data and practices. This disclosure comes on the heels of a recently published Committee report on diversity and inclusion among large banks with more than $50 billion in assets. That report was the result of a data request Chairwoman Waters and Diversity and Inclusion Subcommittee Chair Joyce Beatty sent to 44 financial institutions, not including Visa.

Click here to learn more.

|

|

Committee Launches Bipartisan Counter-Trafficking Initiative

On Wednesday, Chairwoman Waters, Congressman Patrick McHenry (R-NC), Ranking Member of the House Financial Services Committee, Congressman Emanuel Cleaver (D-MO), Chairman of the Subcommittee on National Security, International Development and Monetary Policy, and Congressman French Hill (R-AR), Ranking Member of the Subcommittee on National Security, International Development and Monetary Policy, launched the bipartisan Counter-Trafficking Initiative.

This long-term Committee effort is designed to explore and expose the breadth and reach of transnational trafficking networks and their illicit finances.

| "Trafficking is a national-security threat and often violates human rights and dignity," said Chairwoman Waters. |

|

|

"Trafficking- of any kind - has no place in our society," said Ranking Member McHenry |

| "Trafficking is a problem everywhere, including in Missouri and every community across the United States," said Subcommittee Chairman Cleaver. |

|

|

"Enacting policies to strengthen natinoal security is one of the best ways to combat all types of trafficking," said Subcommittee Ranking Member Hill |

Click here for full statements and additional details on this bipartisan initiative.

As Seen on FSC-TV

In case you missed this week’s Committee activities, see below for a snippet of the infographics displayed on the hearing room big screens.

March 4: Subcommittee Hearing on Illicit Trade in People, Animals, Drugs and Weapons.

March 4: Subcommittee Hearing on Discrimination in the Auto Insurance Industry

Member Spotlight

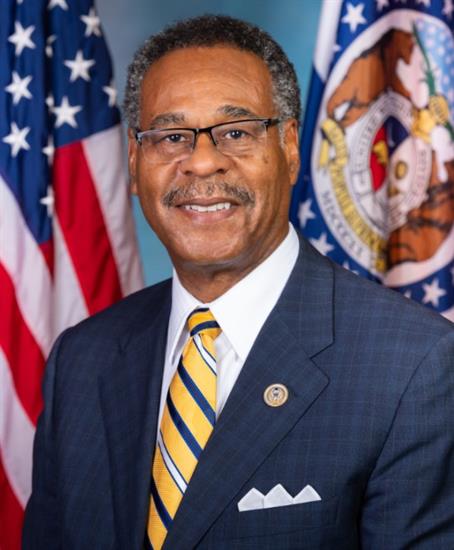

Congressman Al Green (D-TX), Chairman of the Subcommittee on Oversight and Investigations

“This report underscores federal regulators’ repeated failure to hold Wells Fargo accountable for admitted wrongdoing that has harmed millions of Wells Fargo customers. When wrongdoers agree to settlements to make their victims whole, we rely on federal regulators to enforce the terms of those agreements. This report demonstrates not only that Wells Fargo is failing to comply with the terms of multiple settlement agreements dating back to 2016 and 2018, but also that our federal regulators have simply failed to enforce those agreements, despite having ample tools and authorities under existing law to do so. Unfortunately, those who pay the price of these failures are those least able to pay and most in need of protection – customers initially victimized by the bank. The status quo is unacceptable and must not continue. Wells Fargo must be held to its obligations to restore those whom it has harmed, and it must end the abuses of consumers as well as the conditions of the bank that have allowed and promoted such abuses.” -Chairman Green on the recently released Majority staff report entitled, “The Real Wells Fargo: Board & Management Failures, Consumer Abuses, and Ineffective Regulatory Oversight.”

|