|

Waters Opening Statement at September Full Committee Markup to Advance the Build Back Better Act and Critical Housing Legislation

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, gave the following opening statement at a full Committee hybrid markup.

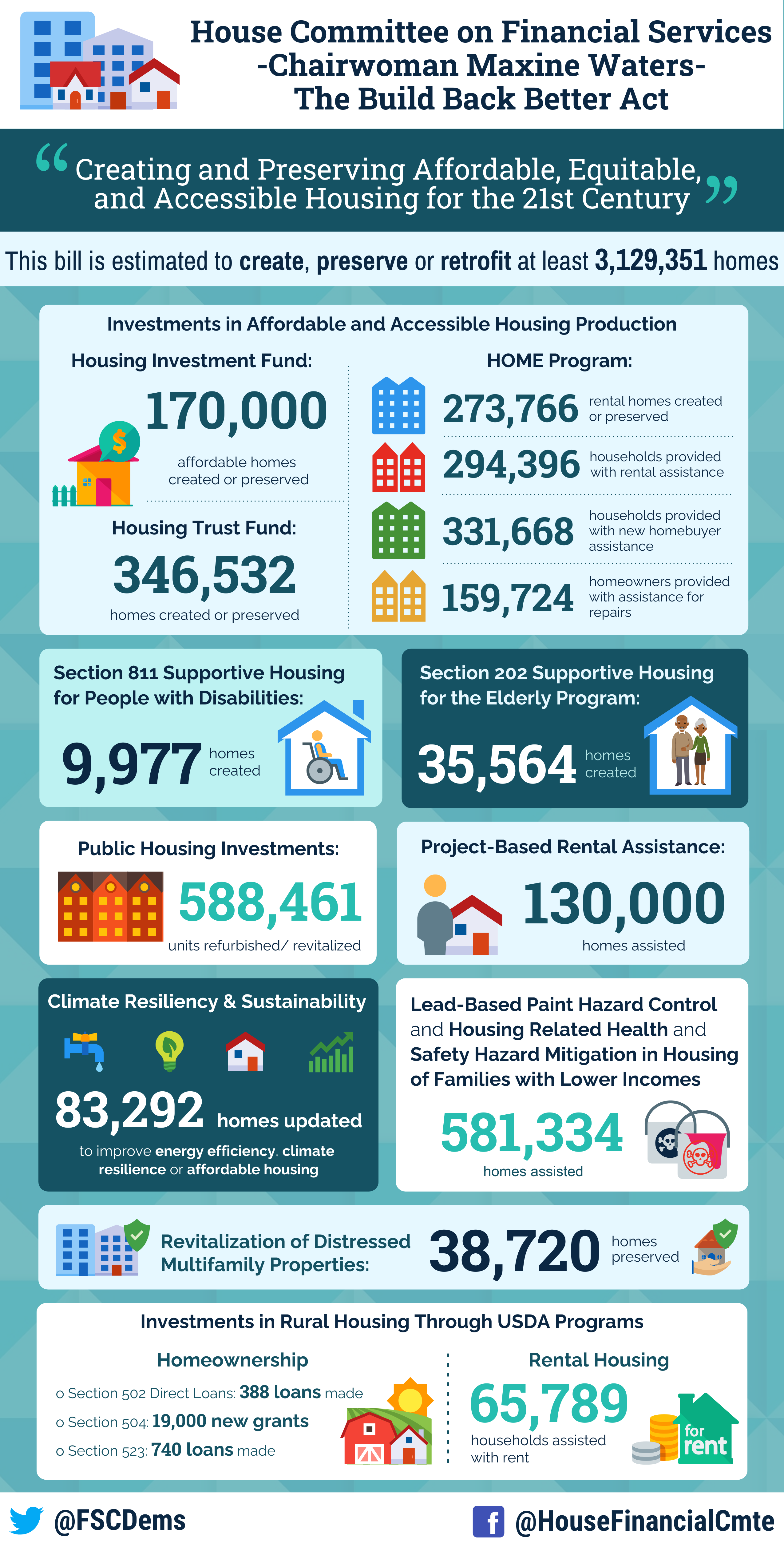

Today, this Committee will mark up a key part of the President’s Build Back Better agenda, legislation that will provide a critical investment of $322 billion toward our nation’s affordable housing infrastructure. For the first time in decades, Congress is taking decisive action toward remaking our nation’s housing to be safer, greener, more inclusive, and affordable. The landmark Build Back Better Act will set our country on a path to ending homelessness, it will create or rehabilitate millions of affordable housing units, it will bring sustainable homeownership within reach for millions of first-generation and first-time homebuyers, it will eliminate the debt of the nation’s flood insurance program, and it will provide important investments in communities that have been left behind for too long...

Click here to read her opening statement.

###

Financial Services Committee 9/13 Markup

Representative Madeleine Dean (D-PA) Statement

House Committee on Financial Services Chairwoman Waters

Build Back Better Act Fact Sheet

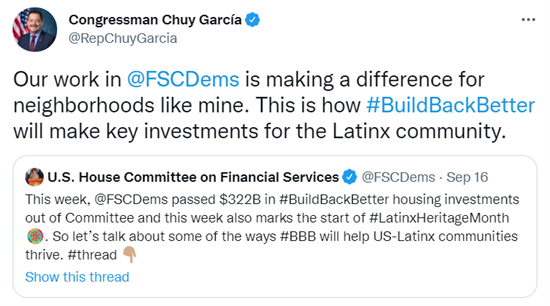

Tweets of the Week

###

|

|

Member Spotlight

| Congresswoman Carolyn Maloney (D-NY) |

Congresswoman Carolyn Maloney (D-NY), serves on the Subcommittee on Investor Protection, Entrepreneurship and Capital Markets and the Subcommittee on Housing, Community Development and Insurance for the 117th Congress. Representative Maloney also chairs the House Committee on Oversight and Reform.

Representative Carolyn Maloney’s (D-NY) Statement at this week’s markup

###

Weekend Reads

###

Waters on Expediting Emergency Rental Assistance to Renters and Landlords: Our Work Is Not Done

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, gave the following statement at a full Committee hearing entitled, “Protecting Renters During the Pandemic: Reviewing Reforms to Expedite Emergency Rental Assistance to Renters and Landlords.”

From the very beginning of this pandemic, I have sounded the alarm about the urgent need for congressional action to avert a massive spike in our national eviction crisis. As Chairwoman of this Committee, I understand the devastating impacts evictions have on families, and I also understand how much landlords, particularly small mom and pop landlords, are struggling because of unpaid rent. I also recognize that evictions increase the spread of COVID and have the potential to seriously set back our national economic recovery. That is why I have worked around the clock on this issue.

I’m reminded as I’ve worked on this issue that we have extended the moratorium — between the Congress of the United States and CDC — six times. Thankfully, due to the hard work of this Committee, in 2020, Congress passed $25 billion in emergency rental assistance and provided an extension of the federal eviction moratorium. Several months later, under the leadership of President Biden, Democrats passed an additional $21.6 billion in emergency rental assistance as part of the American Rescue Plan Act.

But our work is not done. I am very concerned about data showing that state and local governments have only used 11 percent of the $46.6 billion in emergency rental assistance funds that are available. There is no question that the funds are not reaching landlords and renters quickly or widely enough.

In addition, the Supreme Court’s action along partisan lines to lift the CDC’s eviction moratorium puts millions at risk of eviction even as the Delta variant causes a deadly resurgence of the virus.

That is why I have introduced new legislation, the “Expediting Assistance to Renters and Landlords Act of 2021,” which is designed to make sure that individuals and families are not put out of their homes while this virus continues to harm communities across the country.

This bill would allow landlords to apply directly for back rent they are owed, even if a renter is unresponsive, as long as the landlord provides notice and meets other conditions, including a requirement that tenants may not be evicted for at least 120 days — and that the landlords would be paid for those 120 days following the first request for assistance…

Click here to read her opening statement.

###

September Committee Calendar Updates

- September 21 at 10:00 AM ET: The Task Force on Financial Technology will convene for a hybrid hearing entitled, “Preserving the Right of Consumers to Access Personal Financial Data.”

- POSTPONED: The Subcommittee on Investor Protection, Entrepreneurship and Capital Markets will convene for a hybrid hearing entitled, “Taking Stock of “China, Inc.”: Examining Risks to Investors and the U.S. Posed by Foreign Issuers in U.S. Markets.”

- September 23 at 10:00 AM ET: The Subcommittee on National Security, International Development and Monetary Policy will convene for a hybrid hearing entitled, “Lending in a Crisis: Reviewing the Federal Reserve’s Emergency Lending Powers During the Pandemic and Examining Proposals to Address Future Economic Crises.”

- September 28 at 10:00 AM ET: The Subcommittee on Diversity and Inclusion will convene for a hybrid hearing entitled, “Access Denied: Eliminating Barriers and Increasing Economic Opportunity for Justice-Involved Individuals.”

- September 29 at 10:00 AM ET: The Subcommittee on Consumer Protection and Financial Institutions will convene for a hybrid hearing entitled, “The Future of Banking: How Consolidation, Nonbank Competition, and Technology are Reshaping the Banking System.”

- September 30 at 10:00 AM ET: The full Committee will convene for a hybrid hearing entitled, “Oversight of the Treasury Department's and Federal Reserve's Pandemic Response.”

All hearings are livestreamed on https://democrats-financialservices.house.gov/live/.

Due to the COVID-19 Delta variant, all markups and hearings will be in hybrid format. Members and witnesses may participate remotely via Cisco WebEx or participate in-person in room 2128 Rayburn House Office Building.

Committee activities are finalized once an official notice is issued by the House Financial Services Committee.

Visit https://democrats-financialservices.house.gov/calendar/ for the most up-to-date Committee schedule.

###

Chairwoman’s Corner

Waters Endorses Nomination of Sandra L. Thompson as Director of FHFA

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Financial Services Committee, released a statement calling for Federal Housing Finance Agency (FHFA) Acting Director Sandra Thompson to be nominated to lead the agency.

“Today, I call on President Biden to nominate Sandra L. Thompson as Director of the Federal Housing Finance Agency (FHFA). As an independent agency, the FHFA has a statutory obligation to ensure our nation’s housing market remains liquid and stable while expanding access to fair and affordable conventional mortgage lending. As Congress and the Biden Administration work to pass the Build Back Better Act, it will be critical to have an FHFA Director who is committed to advancing housing affordability, expanding the dream of homeownership, and closing the racial wealth gap in this country.

“Appointed on June 23 as acting director, Ms. Thompson has needed little time to show this nation how uniquely qualified she is to serve at the helm of FHFA. Her understanding of Fannie Mae, Freddie Mac, and the Federal Home Loan Banks as government-sponsored enterprises (GSE) is undeniable. Her commitment to ensuring that the GSEs are both well capitalized and using their status to expand low-cost mortgage credit to all communities is illustrated in her actions. More importantly, her commitment to accountability and transparency will be invaluable to ensuring the GSEs are operating in the best interest of taxpayers..."

Click here to read her press release.

###

|