|

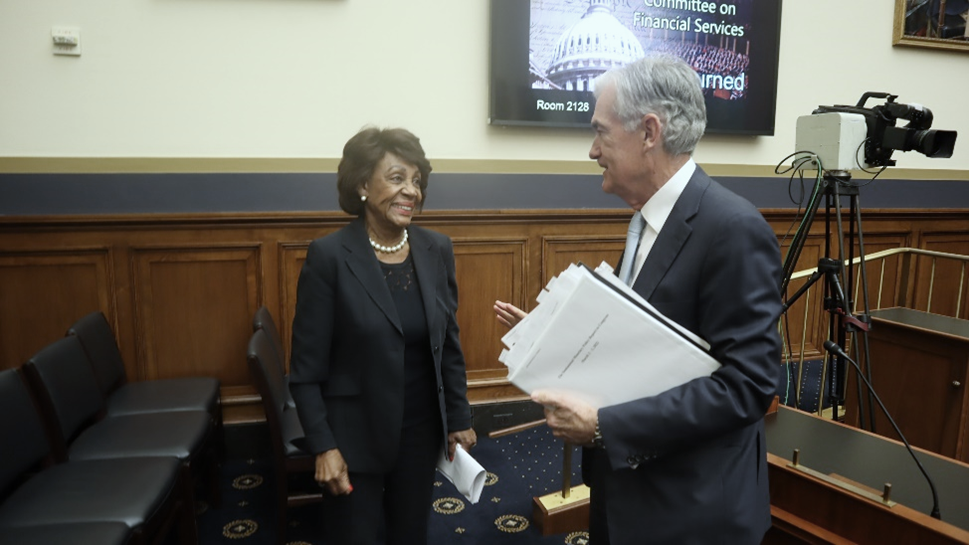

Waters Chairs Semiannual "Humphrey-Hawkins" Hearing with the Federal Reserve

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, gave the following statement at a full Committee virtual hearing entitled, “Monetary Policy and the State of the Economy.”

“I want to start by reiterating that I join with President Biden and our allies in condemning Russia’s shameful, premeditated, and unprovoked invasion of Ukraine. I stand in solidarity with the people of Ukraine.

Chair Pro Tempore Powell, since the last time you testified in July 2021, the United States economy has continued to boom and our recovery from the COVID-19 pandemic is strong. Since the beginning of the Biden Administration in January 2021, our economy added over 7 million jobs, a record in the first year of a new presidency. In addition, wages and salaries for workers grew by 4.5% in 2021—the highest level in close to 40 years…”

Read Chairwoman Waters’ full statement HERE.

Waters, Adams, and Beatty Author Op-Ed Urging Senate Republicans to End Their Block of Well Qualified Federal Reserve Nominees

This week, Congresswoman Maxine Waters (D-CA), Chairwoman of the House Financial Services Committee, Congresswoman Alma Adams (D-NC), and Congresswoman Joyce Beatty (D-OH), released an op-ed on the need to confirm President Biden’s nominees to the Federal Reserve.

Senate Republicans must end their block of well qualified Federal Reserve nominees:

“The Federal Reserve’s leadership has never reflected the diversity of the American public. Only three Black men have ever served on the Board of Governors, and there has never been a Black woman or a Latinx Federal Open Market Committee (FOMC) participant. President Biden acted to change that, but last week Senate Banking Committee Republicans held up their nominations by refusing to show for a vote.

President Biden’s slate of qualified and diverse individuals—Chair Jerome Powell, Dr. Lael Brainard, Sarah Bloom Raskin, Dr. Lisa Cook, and Dr. Philip Jefferson—would complete the first fully confirmed seven-member Federal Reserve Board in nearly 10 years. As members of the House Financial Services Committee, we understand the urgency of having the Federal Reserve at its full capacity, especially during this critical time of high prices and economic uncertainty. As such, we urge the Senate to quickly confirm these nominees for the good of our country and economy.

All five nominees are committed to fighting inflation, fostering financial stability, full employment, and recovery through the pandemic, and equitable economic growth that removes barriers faced by workers of color. These nominees provide a sensible mix of continuity and change, bringing fresh perspectives to once-neglected issues and diverse voices to the FOMC, a consensus-based, deliberative body... “

Read the full Op-Ed HERE.

|

|

|

Member Spotlight

| Congresswoman Alma Adams (D-NC) |

Congresswoman Adams (D-NC) serves on the Subcommittee on Oversight and Investigations and the Task Force on Artificial Intelligence. This week, Rep. Adams co-authored an op-ed with Chairwoman Waters and Rep. Beatty, Chair of the Subcommittee on Diversity and Inclusion. The op-ed, published in The Hill, explains why it is critical that we fill the vacancies on the Federal Reserve Board with the exceedingly qualified nominees that President Biden has selected, why the Fed must reflect the nation’s diversity, and urged Senate Republicans to end their blockade of the nominees’ confirmation processes.

Weekend Reads

###

Committee Hearings

This week, the Committee convened a full Committee hybrid hearing entitled, “Monetary Policy and the State of the Economy.” The Honorable Jerome H. Powell, Chair Pro Tempore, Board of Governors of the Federal Reserve System, discussed the state of the economy and the Federal Reserve’s strategy to combat inflation.

Read Chairwoman Waters’ opening statement HERE.

Upcoming Committee Dates

- March 8 at 10:00 AM ET: The full Committee will convene for a hybrid hearing entitled, “The Inflation Equation: Corporate Profiteering, Supply Chain Bottlenecks, and COVID-19.”

- March 16 at 10:00 AM ET: The full Committee will convene for a hybrid markup.

- March 29 at 10 AM ET: The full Committee will convene for a hybrid hearing entitled, “The Future of Money: Assessing the Benefits and Risks of a U.S. Central Bank Digital Currency.”

- March 30 at 10:00 AM ET: The Task Force on Artificial Intelligence will convene for a hybrid hearing entitled, “Keeping Up with the Codes – Using AI for Effective RegTech.”

- March 30 at 2:00 PM ET: The Subcommittee on Investor Protection, Entrepreneurship and Capital Markets will convene for a hybrid hearing entitled, “Oversight of America's Stock Exchanges: Examining Their Role in Our Economy.”

- March 31 at 10:00 AM ET: The Subcommittee on Consumer Protection and Financial Institutions will convene for a hybrid hearing entitled, “The End of Overdraft Fees? Examining the Movement to Eliminate the Fees Costing Consumers Billions.”

All hearings are livestreamed on https://democrats-financialservices.house.gov/live/.

Due to the latest information available regarding COVID-19, all hearings this month are fully virtual. Members and witnesses may participate remotely via Cisco WebEx.

Committee activities are finalized once an official notice is issued by the House Financial Services Committee. Visit https://democrats-financialservices.house.gov/calendar/ for the most up-to-date Committee schedule.

ICYMI: Waters Releases Report on Committee’s 117th Congress Accomplishments

Chairwoman Waters released a report on the Committee’s work during the first session of the 117th Congress. During a time of crisis, the Committee continued to work tirelessly to provide relief and protections to individuals, families, and small businesses across the nation.

Watch the video highlighting the Committee's accomplishments in the 117th Congress.

Chairwoman’s Corner

Waters, Brown, Gottheimer Request Information on Financing of Domestic Violent Extremism

Chairwoman Waters (D-CA), Senator Sherrod Brown (D-OH), Chairman of the Committee on Banking, Housing, and Urban Affairs, and Congressman Josh Gottheimer (D-NJ), sent a letter to the Government Accountability Office (GAO) requesting a review of the methods by which domestic violent extremists (DVE) and homegrown violent extremists (HVE) fund their activities and how financial institutions are addressing the risks posed by these extremists.

“...Federal law enforcement and the intelligence community assess that the greatest terrorism threat to our country is posed by lone actors or small cells who typically radicalize online and look to attack soft targets with easily accessible weapons," the lawmakers wrote. “...more information on the funding of domestic terrorism and violent extremism is required to understand how financial data and analytical tools can more effectively be used to combat this problem.”

During the 117th Congress, the House Financial Services Committee has sought to prevent bad actors from exploiting our financial system to finance their violent actions. In February 2021, the National Security, International Development and Monetary Policy Subcommittee convened a hearing entitled, “Dollars Against Democracy: Domestic Terrorist Financing in the Aftermath of Insurrection.”

Read the full letter HERE.

|