|

Waters on Reviewing the Federal Reserve’s Emergency Lending Powers: We Must Ensure the Fed’s Actions Reach Main Street

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, gave the following statement at a Subcommittee on National Security, International Development and Monetary Policy hybrid hearing entitled, “Lending in a Crisis: Reviewing the Federal Reserve’s Emergency Lending Powers During the Pandemic and Examining Proposals to Address Future Economic Crises.”

Thank you very much, Mr. Chairman, for holding this important hearing.

Testifying before our Committee in February 2020, Chair Powell warned that the Federal Reserve’s ability to help the economy in the next recession would be limited. Remarkably, the pandemic was declared one month later, and the Fed exercised an unprecedented expansion of its tools to support the economy.

I believe the Fed’s actions were helpful in jumpstarting the recovery on Wall Street after a devastating shutdown due to the pandemic, and we had to work very hard with the Fed to talk about extending its support to states, cities, and small businesses. We engaged the Chair on the terms that were offered to both the small businesses and corporations. And so, I spent a considerable amount of time dealing with all of these facilities that were being created, and particularly the Main Street facility, where we engaged, again, Chairman Powell on how he could be more helpful to very small businesses.

So, I look forward to hearing from this panel what worked, what didn’t, and what reforms are needed to make sure the Fed’s actions reach Main Street, and not just Wall Street.

###

Subcommittee Hearings

Representative Jim Himes (D-CT) delivers opening statement at this week’s Subcommittee on National Security, International Development and Monetary Policy hearing on the Federal Reserve’s emergency lending power.

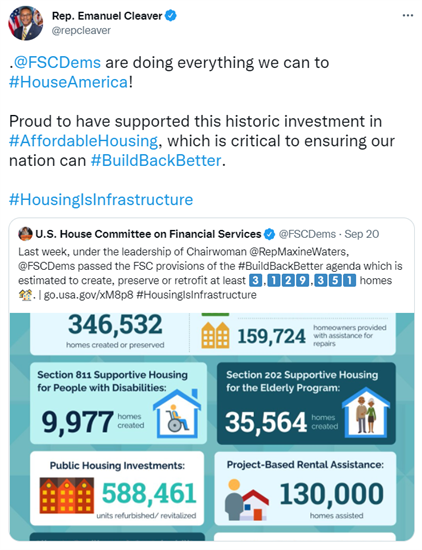

Tweets of the Week

###

|

|

Member Spotlight

| Congressman Stephen Lynch (D-MA) |

Congressman Stephen Lynch (D-MA) is the Chair of the Task Force on Financial Technology for the 117th Congress. He also serves on the Subcommittee on National Security, International Development and Monetary Policy and the Subcommittee on Diversity and Inclusion.

This week, Rep. Lynch chaired the Subcommittee’s hearing, entitled “Preserving the Right of Consumers to Access Personal Financial Data.”

Representative Stephen Lynch (D-MA) chaired this week’s task force hearing on preserving the right of consumers to access their data.

###

Weekend Reads

###

September Is National Preparedness Month

Be ready! September is National Preparedness Month – a reminder for households and businesses to take action to prepare for disasters and emergencies, including gathering and safeguarding important documents, updating emergency kits and supplies, and signing up for emergency alerts.

###

September Committee Calendar

- September 28 at 10:00 AM ET: The Subcommittee on Diversity and Inclusion will convene for a hybrid hearing entitled, “Access Denied: Eliminating Barriers and Increasing Economic Opportunity for Justice-Involved Individuals.”

- September 29 at 10:00 AM ET: The Subcommittee on Consumer Protection and Financial Institutions will convene for a hybrid hearing entitled, “The Future of Banking: How Consolidation, Nonbank Competition, and Technology are Reshaping the Banking System.”

- September 30 at 10:00 AM ET: The full Committee will convene for a hybrid hearing entitled, “Oversight of the Treasury Department's and Federal Reserve's Pandemic Response.”

All hearings are livestreamed on https://democrats-financialservices.house.gov/live/.

Due to the COVID-19 Delta variant, all markups and hearings will be in hybrid format. Members and witnesses may participate remotely via Cisco WebEx or participate in-person in room 2128 Rayburn House Office Building.

Committee activities are finalized once an official notice is issued by the House Financial Services Committee.

Visit https://democrats-financialservices.house.gov/calendar/ for the most up-to-date Committee schedule.

###

Chairwoman’s Corner

Waters Applauds World Bank Decision to Discontinue the Doing Business Report

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Financial Services Committee, released the following statement on the World Bank’s decision to discontinue the “Doing Business” report.

“I am very pleased that the World Bank decided to end its annual country-ranking exercise known as the “Doing Business” report. I’ve long been critical of the “Doing Business” report’s deregulatory bias and its flawed methodology and economically irrational approach to development. I believe the report should have been abandoned long ago.

“In fact, I successfully fought for the elimination of the most controversial indicator in the report called “Employing Workers,” which was used to encourage governments to weaken worker protections with the purported aim of attracting foreign investment. The indicator was initially suspended a decade ago in response to pressure from this Committee, and after I made it clear to the Administration and the Bank that my cooperation in advancing congressional authorization for the World Bank’s recent capital increase was dependent on its elimination, World Bank Group President David Malpass committed to its permanent removal from the report.

“Independent and serious assessments of the “Doing Business” report have not found any credible link between the report’s indicators and positive development or economic outcomes. External evaluations have also consistently raised concerns about the quality and reliability of the data used to create the Doing Business index, and the lack of transparency into how the data is compiled and analyzed.

“The investigative report recently released by the World Bank detailing undue influence by China at the highest levels of the Bank, and the role that the current head of the International Monetary Fund (IMF) played, as then-CEO of the Bank, in manipulating “Doing Business” data at the behest of the Chinese government is very troubling.

“This has undermined the reputation of the World Bank, and it has also called into question the current leadership at the IMF, where the integrity of data is critical to its mission, and where undue influence by any self-interested power could put the stability of the global financial system at risk. I urge quick action by the IMF Board of Directors to demonstrate that preserving the integrity of the Fund remains the priority objective."

###

|