|

Committee Holds Hybrid Hearing, Secretary Mnuchin and Chair Powell Testify on Their Agencies’ Coronavirus Pandemic Response

On Tuesday, the full Committee held a virtual hearing entitled, “Oversight of the Treasury Department’s and Federal Reserve’s Pandemic Response.”

The virtual hearing panelist included:

Click here to watch the virtual roundtable.

Waters at Oversight Hearing on Pandemic Response: The Trump Administration Has Utterly Failed in Its Economic Response to This Virus

On Tuesday, Congresswoman Maxine Waters (D-CA), Chairwoman of the House Financial Services Committee, gave the following statement at a full Committee hearing entitled, “Oversight of the Treasury Department’s and Federal Reserve’s Pandemic Response.”

“Welcome back, Chair Powell and Secretary Mnuchin.

Since you last testified before this Committee in June, the coronavirus crisis has continued to have a catastrophic impact on communities across the country.

Nearly 200,000 people in the United States have lost their lives to the coronavirus, and there have been over 6.8 million U.S. cases.

Millions of families are struggling to make ends meet during this crisis, and are on the verge of eviction. Over a million small businesses, which are the life blood of our economy, have shut their doors.

As families across the country are looking to Washington for leadership, the Trump Administration has utterly failed in its economic response to this virus.

With 32 percent of renters unable to make their full September rent payment at the beginning of the month according to Apartment List, and back rent piling up, the need for emergency rental assistance to prevent a crushing wave of evictions is growing every day. Instead of rental assistance, the Trump Administration has issued a Centers for Disease Control and Prevention (CDC) action that temporarily prevents evictions for some renters, but only after they sign documents that potentially expose them to litigation and criminal penalties.

Meanwhile, the unpaid back rent continues to accrue, meaning that the Trump Administration is simply delaying, not preventing evictions. The Heroes Act, which passed the House in May to prevent those evictions and provide other critical relief, is gathering dust on Mitch McConnell’s desk….”

Click here to read her full statement.

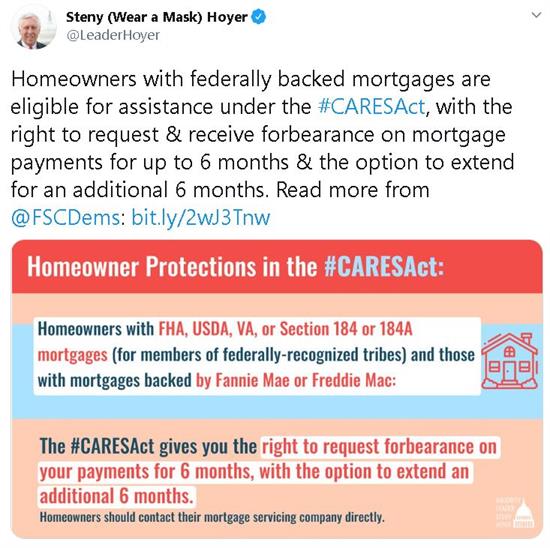

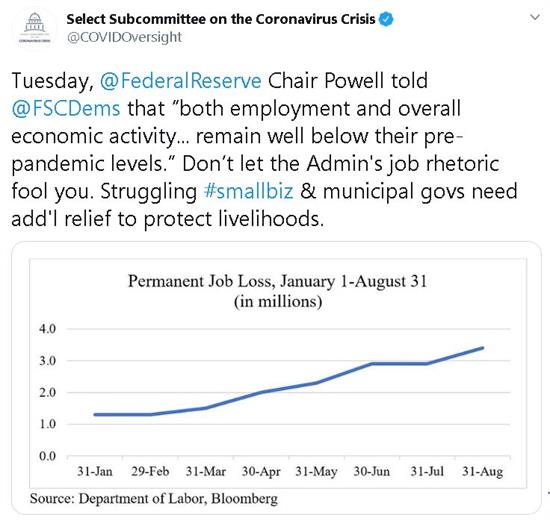

Tweets of the Week

Weekend Reads

|

|

Member Spotlight

| Rep. Stephen F. Lynch (D-MA) |

This week, Congressman Stephen Lynch (D-MA), Chairman of the Task Force on Financial Technology, chaired a virtual Members Briefing Regarding Blockchain Technology: Distilling its Functions in Financial Services, which included academics and experts in the field of blockchain technology.

Briefers for this event:

- Neha Narula, Director, MIT Media Lab Digital Currency Initiative

- Aaron Wright, Associate Clinical Professor of Law and Founder/Director, Tech Startup Clinic

- Denelle Dixon, CEO and Executive Director of the Stellar Development Foundation

Watch the virtual briefing here.

House Passes Ten Bipartisan Financial Services Bills

This week, the U.S. House of Representatives passed ten financial services bills, including legislation to support diversity in community banking, protect investors and consumer from pandemic-related fraud, combat trafficking, and promote more flexible CARES Act funding.

The bills passed include:

- The Ensuring Diversity in Community Banking Act (H.R. 5322) a bill by Representative Gregory Meeks (D-NY), which would support minority depository institutions (MDIs) and newly designed "impact banks" (small banks that predominantly lend to low-income borrowers) through a series of reforms to encourage investments in and partnerships with these institutions. This bill passed by voice vote.

- The COVID-19 Fraud Prevention Act (H.R. 6735), a bill by Representative Cindy Axne (D-IA), which directs the CFPB and the SEC to create a collaborative Investor Fraud Working Group to protect investors and consumers from COVID pandemic related fraud. The working group will issue monthly reports to congress on its progress, actions taken to protect investors and consumers, and actions taken to provide resources to victims of fraud. This bill passed by voice vote.

- The STIFLE Act (H.R. 7592), a bipartisan bill by Representatives Ben McAdams (D-UT) and Representative Anthony Gonzalez (R-OH), which directs GAO to study the shared features among trafficking networks, including facilitators, finances, and proceeds. The bill also requires GAO to report recommendations for any legislative or regulatory changes necessary to combat trafficking or the laundering of proceeds from trafficking. This bill passed by voice vote.

- The Uniform Treatment of NRSROs Act (H.R. 6934), a bipartisan bill by Representative Madeleine Dean (D-PA), which would amend the CARES Act to provide that the ratings of any nationally recognized statistical rating organizations (NRSROs) approved by the SEC may be used by companies for purposes of eligibility for certain programs carried out in response to the COVID-19 emergency (as opposed to the three NRSROs currently in use). This bill passed by voice vote.

- The Promoting Secure 5G Act (H.R. 5698), a bill by Representative William Timmons (R-SC), which would establish as a U.S. policy within the IFIs to only finance 5G projects and other wireless technologies that include adequate security measures in furtherance of national security aims to protect wireless networks from bad actors and foreign governments. This bill passed by voice vote.

- The Improving Emergency Disease Response via Housing Act (H.R. 6294), a bill by Representative Scott Tipton (R-CO), which requires HUD to share data with HHS about the locations of section 202 housing properties and local Continuums of Care (CoCs) with high concentrations of people experiencing unsheltered homelessness in order to identify potential hotspots and provide greater relief for elderly and homeless populations. This bill passed by voice vote.

- The Negro Leagues Baseball Centennial Commemorative Coin Act (H.R. 4104), a bipartisan bill by Representative Emanuel Cleaver (D-MO). This commemorative coin marks the 100th anniversary of the establishment of the Negro National League, a professional baseball league formed in response to African-American players being banned from the major leagues. This bill passed by unanimous consent.

- The Circulating Collectible Coin Redesign Act (H.R. 1923), a bipartisan bill by Representative Barbara Lee (D-CA), which creates a nine-year circulating coin program and authorizes the Mint to redesign and issue circulating coins based on several thematic programs, including prominent American women. This bill passed by unanimous consent.

- The 1921 Silver Dollar Coin Anniversary Act (H.R. 6192), a bipartisan bill by Representative Andy Barr (R-KY). This commemorative coin honors the 100th anniversary of completion of coinage of the “Morgan Dollar” whose designs celebrated the country’s westward expansion and the 100th anniversary of commencement of coinage of the “Peace Dollar” which commemorated the declaration of peace between the United States and the Imperial German government following the end of World War I. This bill passed by unanimous consent.

- The Merrill's Marauders Congressional Gold Medal Act (S.743), a bipartisan bill by Senator Johnny Isakson (R-GA), which directs Congress to award a Congressional Gold Medal to the 5307th Composite Unit (Provisional), commonly known as Merrill's Marauders, in recognition of their bravery and outstanding service in the jungles of Burma (Myanmar) during World War II. Following its award, the gold medal shall be given to the Smithsonian Institution where it shall be displayed and made available for research. This bill passed by unanimous consent..

Chairwoman’s Corner

Chairwoman Waters Blasts Wells Fargo CEO’s Remarks on Recruiting Diverse Executives: On Thursday, Chairwoman Maxine Waters, issued the following statement regarding Wells Fargo CEO Charles Scharf’s remarks on the recruitment of Black executives.

“Charlie Scharf’s comments—spoken to Wells Fargo employees in June and then later memorialized in a memo to them—are sadly familiar to Black people who work in the financial services industry. It’s a refrain that many of them have heard even when they are denied jobs for which they are clearly qualified. It’s been repeated so often that it has become a trope. The truth, however, is that Scharf’s comments are not just an excuse, they are also highly inaccurate. There are qualified people of color in the industry and within Wells Fargo. The problem is that Mr. Scharf does not see them or make a full effort to include such people in his professional circles. To be clear, the financial services industry must do better in terms of diversity and inclusion. This is precisely why I created Congress’ first Subcommittee on Diversity and Inclusion when I took over as the first Chairwoman of the Financial Services Committee last year. Led by Chair Beatty, the Subcommittee has shined a light on the issues surrounding diversity and inclusion in the financial services industry, including in America’s largest banks.

"Earlier this year, the Committee released a staff report on diversity and inclusion at the 44 largest banks. The report, which was based on the banks’ own data, shows that Mr. Scharf isn’t alone in his views. Some banks reported that they lack diversity because they are competing for a ”limited pool” of diverse talent. However, the report noted that these institutions may not be doing enough to look in the right places. To increase accountability for diversity and inclusion, the report recommended that banks publicly disclose their diversity data, track and increase their spending with diverse asset managers and suppliers, and increase and disclose their board diversity….”

See the full text of the statement here.

|