|

Otting Finally Appears Before FSC

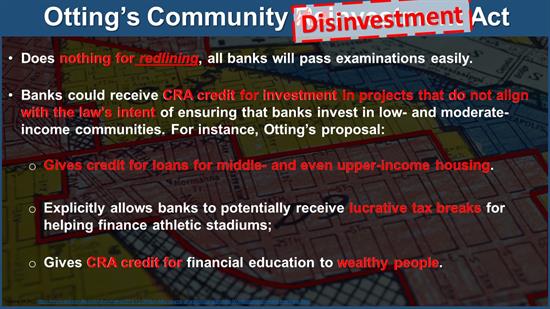

On Wednesday, Joseph Otting, Comptroller of the Currency, appeared before the Committee to explain his harmful Community DISINVESTMENT Act proposal at a hearing entitled, “The Community Reinvestment Act: Is the OCC Undermining the Law’s Purpose and Intent?”

See the Chairwoman’s opening statement here and see below for a throwback clip of the Comptroller telling Committee Democrats he had “never observed” discrimination in 2018.

Chairwoman Waters invited the Office of the Comptroller of the Currency (OCC), Federal Deposit Insurance Corporation (FDIC), the Federal Reserve, and the National Credit Union Association (NCUA) to a full Committee hearing in December to conduct oversight of prudential regulators.

Comptroller Otting was the only regulator invited who did not attend.

|

|

As Seen on FSC-TV

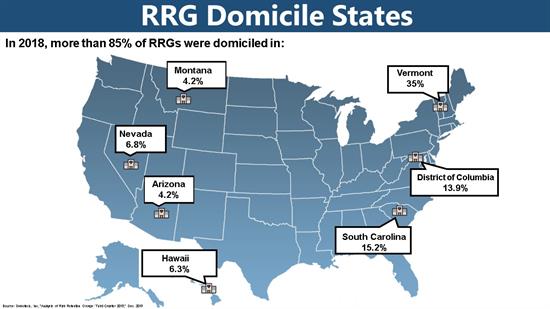

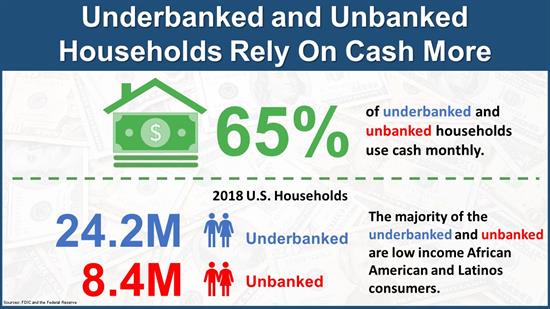

In case you missed this week’s hearings, see below for a snippet of the infographics displayed on the hearing room big screens.

January 29: Full Committee Hearing on the Community Reinvestment Act.

January 29: Subcommittee Hearing on the Availability of Insurance for Nonprofits.

January 30: Task Force Hearing on the Rise of Mobile Payments.

|

|

Member Spotlight

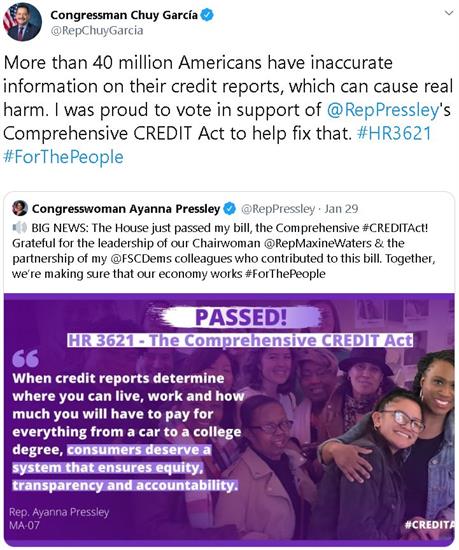

| Congresswoman Ayanna Pressley (D-MA) |

"According to CFPB data, the watchdog agency has received more than 326,000 complaints against credit reporting agencies since 2012, which accounts for nearly 22 percent of the total complaints filed during that time period. According to Pressley’s office, the Comprehensive CREDIT Act comprises tenets of several other bills introduced by fellow members of the House Financial Services Committee.” – Boston.com on Congresswoman Pressley’s bill to reform the broken credit reporting system.

H.R. 3621 passed the House by a vote of 221 to 189.

Tweet of the Week

Weekend Reads

Chairwoman's Corner

Waters Announcers February Schedule: On Tuesday, Chairwoman Waters announced several hearings for the month of February.

- February 5 at 10:00 AM – The full Committee will convene for a hearing entitled, “Rent-A-Bank Schemes and New Debt Traps: Assessing Efforts to Evade State Consumer Protections and Interest Rate Caps.”

- February 5 at 2:00 PM – The Subcommittee on Housing, Community Development and Insurance will convene for a hearing entitled, “A Future Without Public Housing? Examining the Trump Administration’s Efforts to Eliminate Public Housing.”

- February 6 at 10:00 AM – The full Committee will convene for a hearing entitled, “Protecting Consumers or Allowing Consumer Abuse? A Semi-Annual Review of the Consumer Financial Protection Bureau.”

- February 6 at 2:00 PM – The Subcommittee on Oversight and Investigations will convene for a hearing entitled, “Fake It Till They Make It: How Bad Actors Use Astroturfing to Manipulate Regulators, Disenfranchise Consumers and Subvert the Rulemaking Process”

- February 11 at 10:00 AM – The full Committee will convene for a hearing entitled, “Monetary Policy and the State of the Economy.”

- February 12 at 10:00 AM – The Subcommittee on Diversity and Inclusion will convene for a hearing entitled, “A Review of Diversity and Inclusion at America’s Large Banks.”

- February 12 at 2:00 PM – The Task Force on Artificial Intelligence will convene for a hearing entitled, “Equitable Algorithms: Examining Ways to Reduce AI Bias in Financial Services.”

- February 26 at 10:00 AM – The full Committee will convene for a hearing entitled, “Rent-A-Bank Schemes and New Debt Traps: Assessing Efforts to Evade State Consumer Protections and Interest Rate Caps (Part 2).”.

|