|

Waters Floor Statement on Her Comprehensive Debt Collection Reform Bill

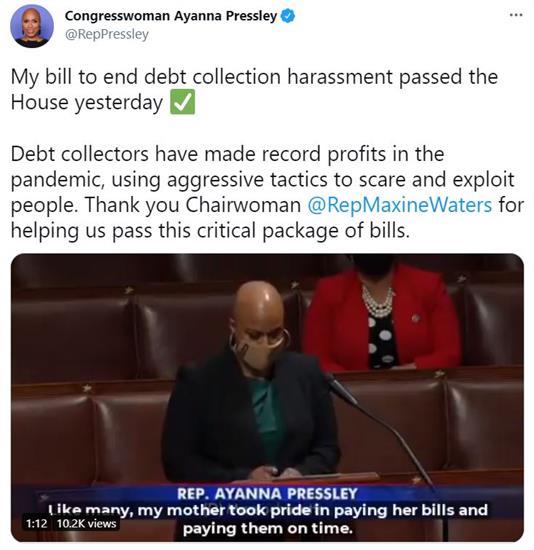

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, gave the following statement on the House floor urging the passage of her bill H.R. 2547, The Comprehensive Debt Collection Improvement Act. The bill passed the House by a vote of 215-207.

Madam Speaker, I rise in strong support of my legislation, H.R. 2547, the Comprehensive Debt Collection Improvement Act. H.R. 2547 is a package of bills designed to bring new protections, fairness, accuracy and transparency to the debt collection industry.

Individuals and families across the country have long struggled with debt – including medical debt, student loan debt, and other debts—and they often face difficult decisions regarding how to pay off their debts.

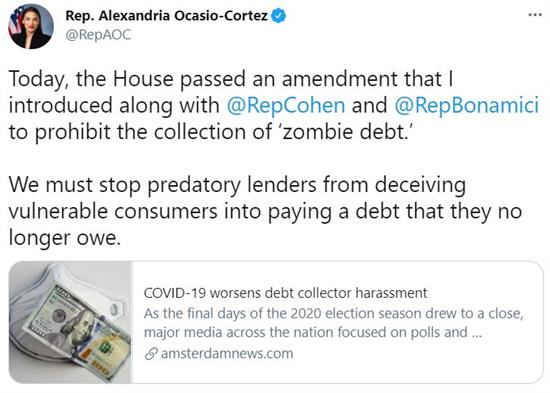

During the pandemic crisis, which has harmed all of our communities, debt collectors have earned record profits. Their tactics are often abusive and predatory. Many debt collectors harass consumers with frequent phone calls, make threats, and provide misleading information to consumers. The debt collection industry is also plagued by poor record-keeping, resulting in many consumers being harassed for debts that they do not owe. Debt collection is among the top issues that the Consumer Financial Protection Bureau receives the most complaints about from consumers, and those complaints have risen since 2019.

This bill, H.R. 2547, brings new accountability to the debt collection industry and stronger protections for consumers from harassment and abuse, including by banning abusive confessions of judgment that have hurt small businesses, prohibiting debt collectors from harassing and threatening servicemembers, barring the collection of medical debt for two years after the debt is incurred, prohibiting debt collectors from contacting consumers by email or text message without a consumer’s affirmative consent, limiting egregious debt collection fees that have disproportionately hurt low-income and minority borrowers, and protecting consumers during a non-judicial foreclosure proceeding...

Click here to read her full statement.

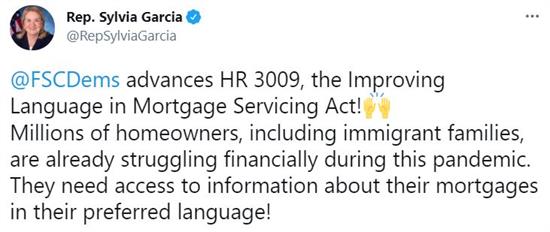

Tweets of the Week

|

|

Member Spotlight

| Congressman Ritchie Torres (D-NY) |

Congressman Ritchie Torres (D-NY), serves on the Subcommittee on Consumer Protection and Financial Institutions, the Subcommittee on Housing, Community Development and Insurance, and the Subcommittee on National Security, International Development and Monetary Policy. He is also a member of the Task Force on Financial Technology. This week, Committee passed Representative Torres’ bill, the LGBTQ Business Equal Credit Enforcement and Investment Act, which would clarify the Dodd-Frank Wall Street Reform and Consumer Protection Act to ensure financial institutions are collecting data on LGBTQ-owned businesses, including a business owner’s self-identified sexual orientation and gender identity.

Weekend Reads

Committee Passes Legislation to Help Combat Lending Discrimination, Support LGBTQ-Owned Businesses, and Hold Public Companies Accountable

The House Committee on Financial Services passed six bills to help combat credit discrimination, ensure fair lending testing, support LGBTQ-owned businesses, improve language access in mortgage servicing, and hold public companies accountable for disclosing pay raise information, climate change risks, and total amounts paid in taxes to better inform investors.

The bills passed by the Committee include:

- The Fair Lending for All Act (H.R. 166), a bill by Representative Al Green (D-TX), which would update the Equal Credit Opportunity Act and Home Mortgage Data Collection Act to help combat discrimination in the consumer marketplace, including on the basis of sexual orientation and gender identity. The legislation would also establish the Office of Fair Lending Testing to ensure discrimination is identified and addressed.

The bill passed the Committee by a vote of 28-24.

- LGBTQ Business Equal Credit Enforcement and Investment Act (H.R. 1443), a bill by Representative Ritchie Torres (D-NY), which would clarify the Dodd-Frank Wall Street Reform and Consumer Protection Act to ensure financial institutions are collecting data on LGBTQ-owned businesses, including a business owner’s self-identified sexual orientation and gender identity. The legislation will also define a LGBTQ-owned business in federal law, which will help support the development needs and opportunities for LGBTQ-owned businesses.

The bill passed the Committee by a voice vote.

- Greater Accountability in Pay Act (H.R. 1188), a bill by Representative Nydia Velázquez (D-NY), which would require public companies with the exception of emerging growth companies to disclose certain executive and employee pay raise information.

The bill passed the Committee by a vote of 29-23.

- Climate Risk Disclosure Act (H.R. 2570), a bill by Representative Sean Casten (D-IL), which would require public companies to disclose the risks they face due to climate change.

The bill passed the Committee by a vote of 28-24.

- Disclosure of Tax Havens and Offshoring Act (H.R. 3007), a bill by Representative Cindy Axne (D-IA), which would require public companies to disclose their total pre-tax profits, and total amounts paid in State, Federal, and foreign taxes.

The bill passed the Committee by a vote of 28-23.

- Improving Language Access in Mortgage Servicing Act (H.R. 3009), a bill by Representative Sylvia Garcia (D-TX), would amend the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act of 1974 (RESPA) to establish language access requirements for creditors and servicers to ensure consumers with limited English proficiency enjoy fair and equal mortgage lending access.

The bill passed the Committee by a vote of 29-24.

Chairwoman’s Corner

Waters Opening Statement at May Full Committee Markup

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, gave the following opening statement at a full Committee hybrid markup.

Today, this Committee will mark up six bills. As Chairwoman of this Committee, I am very pleased to advance several strong legislative solutions that have been introduced by Committee Democrats.

At this markup the Committee will consider a number of bills, continuing with the Committee’s ongoing work to advance racial and gender equity and provide fairness for LGBTQ+ persons, including:

At this markup the Committee will consider a number of bills, continuing with the Committee’s ongoing work to advance racial and gender equity and provide fairness for LGBTQ+ persons, including:

- The Fair Lending for All Act (H.R. 166), a groundbreaking bill by Representative Green that will help combat discrimination in the consumer financial marketplace, including on the basis of sexual orientation and gender identity. This would be done through updates to the Equal Credit Opportunity Act and Home Mortgage Disclosure Act, and through the creation of a CFPB Office of Fair Lending Testing that would incorporate techniques used successfully by researchers to better identify and address discrimination in financial services.

- We will also consider the LGBTQ Business Equal Credit Enforcement and Investment Act (H.R. 1443), a bill by Representative Torres, that would clarify and update Section 1071 of Dodd-Frank to ensure that lending data with respect to LGBTQ-owned businesses are collected, along with small, women-owned, and minority-owned businesses. Transparency is key to cracking down on discrimination in the financial marketplace.

Click here to read her full statement.

|