|

ICYMI: Haunted by Student Debt Past Age 50, New York Times Editorial

By THE EDITORIAL BOARD

The experience of being crushed by student debt is no longer limited to the young. New federal data shows millions of Americans who are retired or nearing retirement face this burden, as well as the possibility of having their Social Security benefits garnished to make payments.

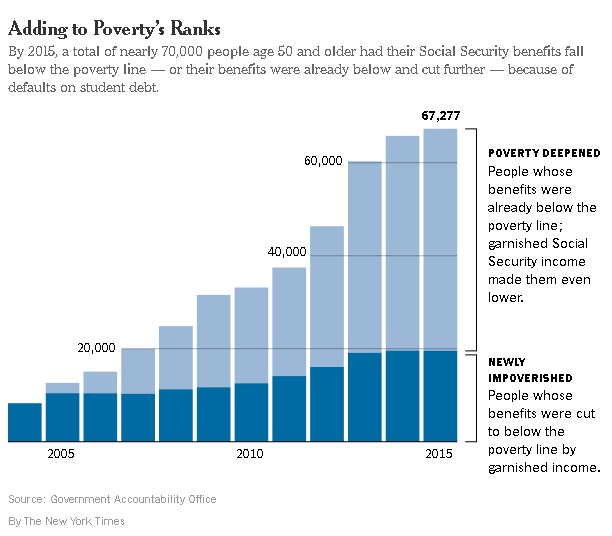

Americans age 60 and older are the fastest-growing age group of student loan debtors. Older debtors, many of whom live hand-to-mouth on fixed incomes, are more likely to default. When that occurs with federal loans, as happens with nearly 40 percent of such borrowers who are 65 and over, the government can seize a portion of their Social Security payments — even if it pushes them into poverty. About 20,000 Americans over the age of 50 in 2015 had their Social Security checks cut below the poverty line because of student loans, with poverty-level benefits falling even further for 50,000 others, according to a recent report by the Government Accountability Office.

A report issued last month by the Consumer Financial Protection Bureau shows that the number of Americans aged 60 and older with student loan debt has grown fourfold over the last decade, to 2.8 million in 2015 from about 700,000 in 2005. The average amount owed by these borrowers has nearly doubled, to $23,500.

Some older borrowers are carrying their own education loans, but most fell into debt helping their children or grandchildren, either by borrowing directly or co-signing loans. As these borrowers age, they have increasing difficulty keeping up loan payments while also paying for food, housing, medication, and dental and medical care.

The federal government needs to give priority to people who are struggling to survive over the companies that collect their loan payments. That means ending the practice of seizing the Social Security benefits of poor or disabled student loan debtors.

Most federal student loan borrowers are eligible for income-based repayment plans under which distressed borrowers can pay as little as nothing per month. Many of those who enroll qualify to have the federal government pay part of their interest charges. And many are eligible to have loans forgiven after specified periods of time.

But loan servicing companies, which sometimes cheat borrowers outright, do a terrible job of enrolling people in this program. This deprives older borrowers of information about payment plans that would allow them to meet their loan obligations without skimping on medical or dental care.

The Consumer Financial Protection Bureau, which recently sued the nation’s largest loan servicing company, is rightly pushing the industry to do a better job of informing borrowers of their rights and enrolling them in the affordable payment program.

Still, the government should do more for older borrowers. For starters, it should automatically enroll them in income-based repayment when their accounts become delinquent — but before they default. Those who have reached default should be enrolled in the rehabilitation plan, which offers affordable payments.

Meanwhile, Congress should exempt Social Security income from garnishment.

Read the full story on NYTimes.com

###

|