|

Waters’ Statement Following Part I of the FTX Hearing with John Ray III

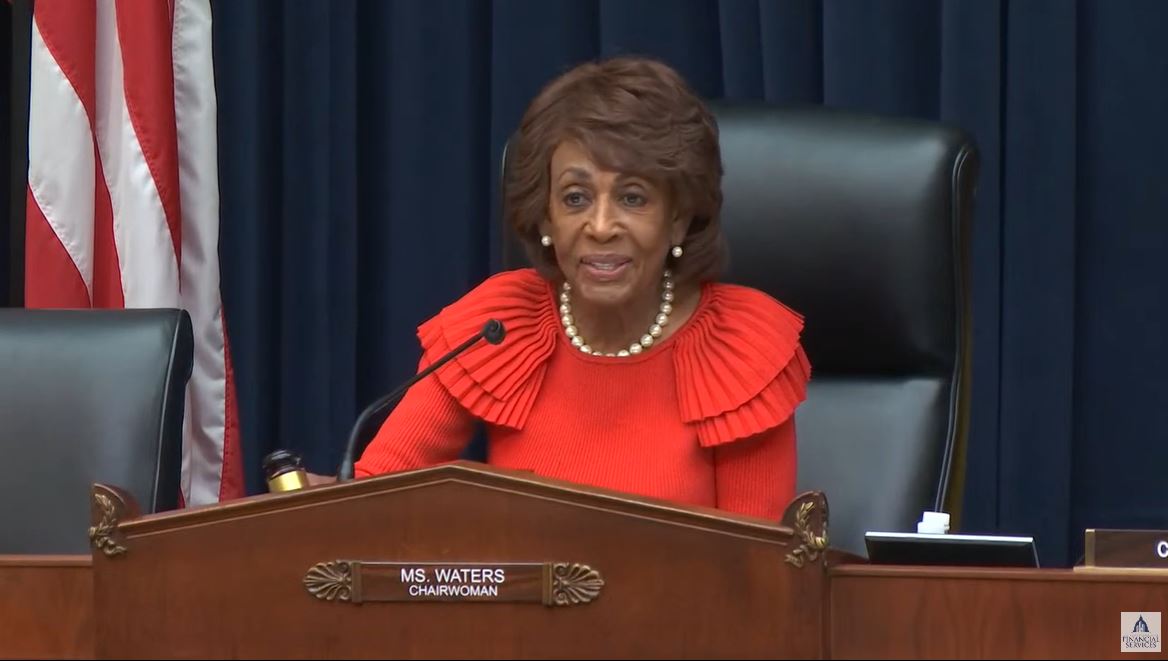

Following the full Committee hearing entitled, “Investigating the Collapse of FTX, Part I” Congresswoman Maxine Waters (D-CA), Chairwoman of the House Financial Services Committee, released the following statement:

“I want to thank Mr. Ray for his participation in the hearing today. Mr. Ray’s task ahead to recover funds for FTX’s million customers is clearly going to be a long and difficult one given the extent of the fraud committed by Mr. Bankman-Fried. This Committee will be closely following his progress and want to know when he encounters obstacles that prevent him from returning funds to customers.

“This Committee is also closely following the Department of Justice’s indictment of Mr. Bankman-Fried on eight criminal counts, including wire fraud, securities fraud and money laundering, and the SEC’s allegations that Bankman-Fried, FTX and Alameda Research committed numerous significant securities violations. I also take pause that the SEC’s civil complaint alleges that Mr. Bankman-Fried misled this Committee last year when he testified. While I believe that justice will be served, I remain concerned that this collapse is an indication of broader challenges to the long-term viability and security of the digital assets industry as a whole…”

Read the full statement HERE.

Chairwoman Waters Statement on the Arrest of Sam Bankman-Fried

Following news that Sam Bankman-Fried was arrested in the Bahamas, Congresswoman Maxine Waters (D-CA), Chairwoman of the House Financial Services Committee, released the following statement:

“I am surprised to hear that Sam Bankman-Fried was arrested in the Bahamas at the direction of the United States Attorney for the Southern District of New York. It’s about time the process to bring Mr. Bankman-Fried to justice has begun. However, as the public knows, my staff and I have been working diligently for the past month to secure Mr. Bankman-Fried’s testimony before our Committee tomorrow morning. We received confirmation this afternoon from Mr. Bankman-Fried and his lawyers that he was still planning to appear before the Committee tomorrow, but then he was arrested…”

Read the full statement HERE.

|

|

|

Member Spotlight

| Congressman Ed Perlmutter (D-C0) |

Congressman Ed Perlmutter (D-CO) is the Chair of the Subcommittee on Subcommittee on Consumer Protection and Financial Institutions. In this week’s full Committee hearing entitled, “Consumers First: Semi-Annual Report of the Consumer Financial Protection Bureau,” Rep. Perlmutter discussed the Consumer Bureau’s guidance vs. enforcement approach. He highlighted that companies benefit by being given clarity through the guidance notices before laying the enforcement hammer. Additionally, during Rep. Perlmutter’s line of questioning, Director Chopra emphasized that the agency’s enforcement is focused on repeat offenders and the largest players in the financial system.

Weekend Reads

###

Waters Applauds SEC’s Adoption of Committee Recommendations to Protect Investors, Strengthen Market Integrity

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, released the following statement in response to the Securities and Exchange Commission’s (SEC) December 14, 2022 rule approval and proposals.

“I am pleased that the Securities and Exchange Commission has adopted rules that incorporate the recommendations from my bill, H.R.1528 “Promoting Transparent Standards for Corporate Insiders Act,” which passed the House with bipartisan support and requires the SEC to stop company executives and others from hiding insider trading through 10b5-1 trading plans. These plans permit certain employees of publicly traded corporations to sell their shares without violating insider trading prohibitions, but several high-profile examples have suggested that current rules are too lax. Like my bill, the action by the SEC—under the leadership of Chair Gary Gensler—would limit the abuses and misuses of 10b5-1 plans. I look forward to continue working with the SEC to further build on the Committee’s efforts to promote transparency and competition, strengthen market integrity and protect investors, as today’s other market structure proposals would.”

Read the full statement HERE.

Full Committee Hearing Investigating the Collapse of FTX

The full Committee convened a hearing entitled, “Investigating the Collapse of FTX, Part I,” and welcomed testimony from John Ray III, who has recently been appointed CEO of FTX to oversee its bankruptcy. At this hearing, the Committee examined the company’s collapse, including the lack of corporate controls, processes, and procedures, the failure of internal operations, and all related-party dealings that resulted in the collapse of FTX. This hearing marked the first in a series of hearings on this topic held by the Committee as part of its quest to uncover the truth behind the collapse of FTX.

- Read Chairwoman Waters’ opening statement HERE.

- Watch the full Committee hearing HERE.

- Read the hearing highlights HERE.

Full Committee Oversight Hearing on the Consumer Financial Protection Bureau

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Financial Services Committee held a hearing entitled, “Consumers First: Semi-Annual Report of the Consumer Financial Protection Bureau.” where CFPB Director, Rohit Chopra, testified before the Committee as part of the agency’s semi-annual report to Congress. During the hearing, Chairwoman Waters and Committee Democrats heard from Director Chopra about the work the CFPB is doing to protect consumers and hold financial institutions accountable for abusive practices that harm consumers.

- Read Chairwoman Waters’ opening statement HERE.

- Watch the full Committee hearing HERE.

- Read the hearing highlights HERE.

Chairwoman’s Corner

Chairwoman Waters, Senator Booker Send Letter to Government Accountability Office Urging Updated Study on Disparities in Asset Management

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Financial Services Committee, and Senator Cory Booker (D-NJ) sent a letter to the United States Government Accountability Office (GAO) highlighting the severe lack of progress our nation’s federally managed pension funds have made in boosting representation of diverse asset management firms over the years. In the letter Chairwoman Waters and Senator Booker urge the agency to investigate these disparities by conducting a comprehensive study that focuses on new metrics that assesses the efforts fund investors, such as federal pension funds, have taken to engage diverse asset managers.

The letter comes after the publication of a comprehensive Financial Services Committee report entitled, “Diversity and Inclusion: Holding America’s Largest Investment Firms Accountable” and two Diversity and Inclusion subcommittee hearings exploring large investment firms and asset managers, respectively.

“Diversity within the asset management industry is not only a matter of fairness for professionals in the financial services sector, but it has wide-ranging impacts on the millions of Americans whose $115 trillion are under management. It has long been documented that minority- and women-owned (MWO) asset management firms perform as well as their peers, yet nearly 99% of assets continue to be managed by White, male-led firms,” said Chairwoman Waters and Senator Booker. “Despite congressional and administrative efforts to address the disparities that limit opportunities for MWO asset managers, there has been little to no progress made over the last decade.”

Co-signers for this letter include: Representatives Alma Adams (D-NC), Joyce Beatty (D-OH), Al Green (TX), Al Lawson (D-FL), Juan Vargas (D-CA), Nikema Williams (D-GA) and Senators Timothy Kaine (D-VA), Ben Ray Luján (D-NM), Robert Menendez (D-NJ), Patty Murray (D-WA) and Elizabeth Warren (D-MA).

Read the full release HERE.

|